Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

8/13/2019

There was a time when someone would circle a date on their calendar to mark when they would stop working altogether and begin retirement.

Things have changed. Today retirement is better defined as a transitional period rather than a singular point in time. Many workers slowly adjust to retired life by scaling down the number of hours they work, shifting responsibilities or changing what they do entirely. In doing so, they are able to extend the numbers of years in the workforce and increase their retirement savings.

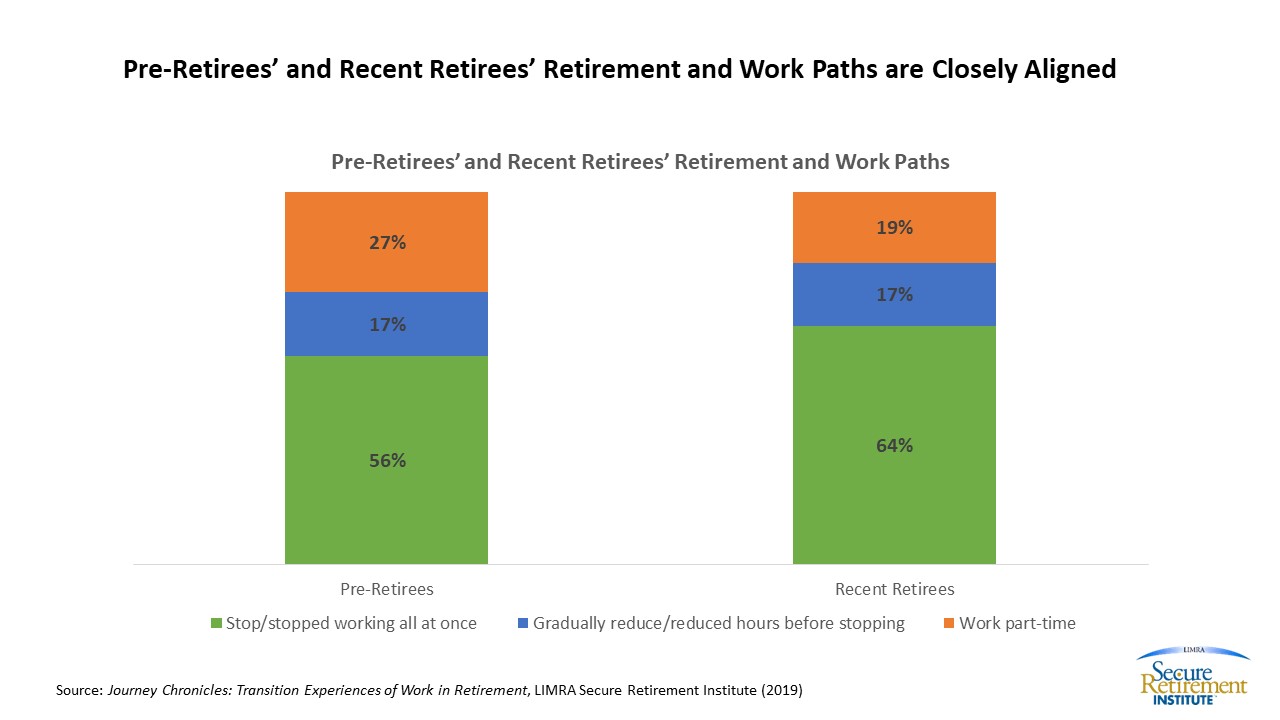

New LIMRA Secure Retirement Institute (LIMRA SRI) research finds pre-retirees and retirees are almost evenly aligned on how they anticipate entering into retirement: 56% said they plan to stop working entirely, 17% plan to gradually reduce their hours before stopping and 27% plan to work part-time with no plan to stop working. In actuality, among recent retirees 64% stopped working all at once, 17% gradually reduced their hours and just 19% continued to work part-time.

The study found women are more likely to phase into retirement than men. A quarter of female recent retirees phased into retirement versus 16% of male recent retirees. Oftentimes, men may be less likely to phase into retirement because it is more difficult to do so with their pre-retirement job functions. For instance, 23% of men worked in managerial job functions before retirement compared with 13% of women.

For the 1 in 5 retirees who continue to work, there are multiple reasons that motivate them, including: staying intellectually engaged, money for discretionary spending, staying physically active, staying socially engaged and enjoying their work. LIMRA SRI finds the top three primary reasons for continuing to work among working recent retirees are for spending money (32%), enjoying their work (19%) and to stay intellectually engaged (14%).

Employment and lifestyle changes can significantly impact consumers’ income and expenses. It is important for financial service companies to have a clear picture of this evolving landscape to help retirees develop an appropriate financial plan.

For employers, it is important to adapt to the preferences of older workers as more retirees continue to work past typical retirement age. More flexible benefits programs may become necessary to meet the divergent needs of age-diverse workers. Benefits providers should consider ways to help employers adapt their offerings to improve recruitment and retention, optimize resources, and understand the impact changing demographics can have on benefits and actuarial assumptions.

With a 50-year record low unemployment rate, employers who make it easy for retirees to work for them may benefit from their experience and expertise.

This findings of this study were based on a survey of recent retirees and pre-retirees (ages 55 – 71) who have retired within the past two years or plan to retire in the next two years and had at least $100,000 in household assets. Data were weighted to be representative of the population based on age, retirement status, and household assets.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184