Surveying the Financial Fraud

Landscape: How Companies are

Tackling Today’s Challenges

Surveying the Financial Fraud

Landscape: How Companies are

Tackling Today’s Challenges

June 2023

To most of us, it’s no surprise to hear crime is up, including financial crime. According to LIMRA’s most recent Financial Crimes Services and Fraud Prevention Study, financial crimes and fraud incidents in the financial services industry increased in 2022, with the biggest jumps coming from unrelated account takeover incidents and senior and vulnerable adult fraud.

This is the third year for LIMRA’s study, which is designed to help companies understand trends and benchmark their prevention programs. Fifty-three member companies responded to the survey, which was fielded in January and February of this year.

Figure 1 – Confirmed Fraud Incidents in 2022 Compared to 2021

(Percent of companies that experienced a decrease, same or an increase)

Notes: Companies could also indicate N/A. Those responses have been excluded from this chart to show the trend for companies where each type of fraud is relevant.

Half of the companies participating in the study reported year-over-year increases in unrelated account takeover incidents, which are unauthorized attempts to access a customer account by an unknown and unrelated third-party imposter.

Senior and vulnerable adult fraud incidents perpetrated by an unrelated party increased for half (50 percent) of the companies, while senior and vulnerable adult fraud incidents perpetrated by a related party — such as a relative, caregiver or friend — increased for nearly half (47 percent) of the companies.

As a result, a whopping 82 percent of companies cited account takeovers/identity theft as their top exposure for 2023. Forty-five percent indicated elder and vulnerable person financial exploitation as their second highest exposure.

There were only two categories in which companies reported a year-over-year decrease in incidents: employee impersonation and internal fraud.

Addressing and preventing financial crimes and fraud takes a team effort. For most companies, compliance and special investigation functions continue to assume the primary responsibilities. However, a growing number of companies have created specialized fraud operations or financial crimes services teams to better focus their efforts. On average, seven teams play active roles in a company’s prevention programs.

Across companies of all sizes, most programs are centralized (42 percent) or partially centralized (47 percent). Eleven percent of the responding companies take a decentralized approach with multiple departments or functions handling financial crimes services or fraud prevention functions and reporting into different departments or product lines with no centralized governance or oversight.

No matter how the program is structured, facilitating effective collaboration and communication among the responsible teams is key. A strong governance framework keeps financial crime services and fraud prevention top of mind and ensures that the program receives appropriate resources and organizational support.

Healthy organizations consider fraud risks when making significant product, process and control decisions. As in last year’s survey, 6 in 10 companies report having a formal oversight committee or group overseeing their program, with an average of five different functional areas participating in these committees. However, compared to the previous year, more companies report the participation of legal (73 versus 87 percent) and fraud operations (55 versus 70 percent) on these committees.

Regular fraud risk assessments are an important way to help ensure all levels of an organization recognize and understand fraud risks. In addition, fraud risk assessments help companies make timely adjustments to their prevention programs and stay up to date on the constantly changing fraud landscape.

While 43 percent of companies reported 2022 as the date of their last fraud risk assessment, 36 percent of respondents have not conducted an assessment in the past three years or have never conducted one.

Along with risk assessments, sharing information broadly throughout the organization is another key element of effective fraud prevention. Regular reporting helps to ensure that people have the information they need to make fraud-aware decisions.

More than four in five companies provide regular reporting to both executive and senior management, and three in four share reports with board members and audit committees. However, less than half of companies provide reporting to middle management, and less than one-third provide it to unit and front-line management.

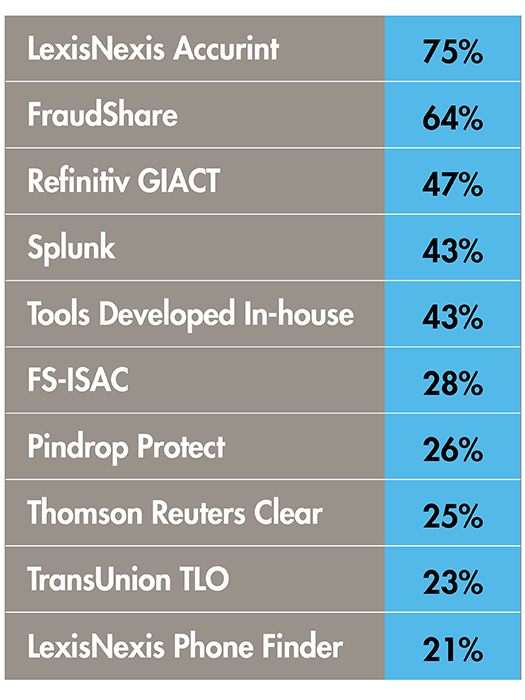

Combating fraud takes a layered approach, as there is no one silver bullet. Companies use an average of six tools to help authenticate, identify and investigate fraud. Two-thirds of companies are considering expanding to use another 2.5 tools.

One of the best ways to prevent fraud is through better authentication. Beyond fraud prevention, sophisticated authentication capabilities can provide additional benefits, including increased customer satisfaction and decreased unit costs.

Companies report using a wide range of methods when authenticating customers and agents/advisors to their interactive voice response (IVR) systems, call centers, websites and mobile apps, as well as when users forget their username or password.

Traditional authentication methods use standard customer identifiers, such as name, Social Security number, date of birth, policy or contract number. More sophisticated methods may also be used, including knowledge-based questions, one-time passcodes sent to a phone or email, authenticator apps, tools that identify the user’s device as being their device, a government ID scan and selfie, analytics on user-behavior patterns, technology-enabled anomaly detection, voice biometrics and more.

Fifty-four percent of companies believe the insurance and retirement services industry is keeping pace with other industries when it comes to utilizing tools and technologies to reduce and prevent fraud. Forty-three percent reported limited resources as the top challenge for combating fraud at their company, replacing 2021’s top challenge – technology adoption, which was the second most cited challenge in 2022. Employee turnover and vigilance was a bigger challenge for more companies, rising to the third ranking from fifth in 2021.

Looking ahead, participating companies ranked their top three areas of focus in 2023. As in the prior year’s study, authentication process and control enhancements took the top spot overall and ranked among the top three for 56 percent of companies. Rounding out the top focus areas, 52 percent listed digital fraud process and control enhancements, and 42 percent cited training and education for employees.

For more insights about financial crime and fraud prevention programs and priorities, explore the complete findings from the third annual Financial Crimes Services and Fraud Prevention Study.