Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

11/16/2023

Seven in 10 Americans admit that something about their financial situation “scares” them, according to LIMRA’s fourth quarter 2023 Consumer Sentiment Survey. Half as many (34%) report feeling highly stressed about their personal finances, similar to levels reported throughout 2023.

In an effort to understand the nuances of financial stress, LIMRA asked 3,000 consumers to share what, if anything, about their finances “scares” them. Their candid responses serve as good reminder that 1) financial fears differ by life stage, wealth, and circumstances that can’t be ignored and 2) most adults are scared about something when it comes to their finances, regardless of their perceived financial security.

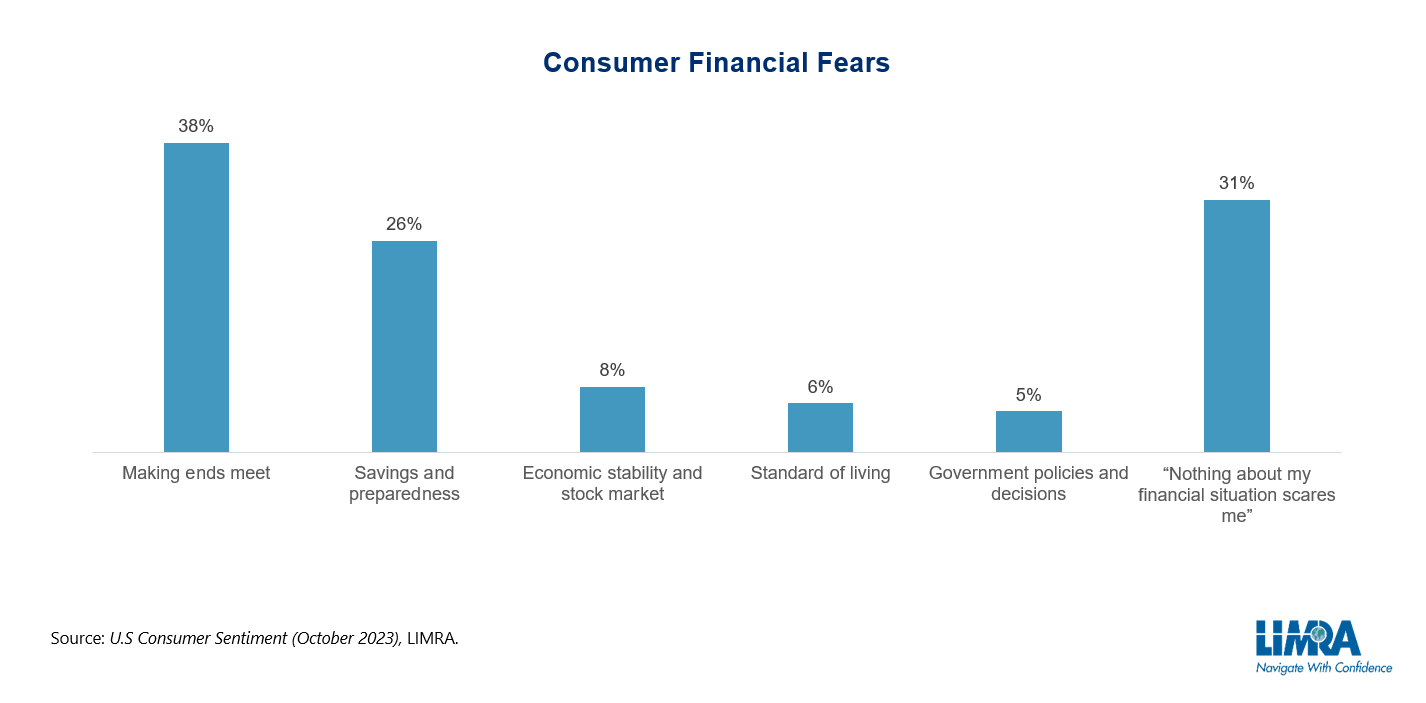

Nearly 4 in 10 consumers described fears around making ends meet. Inflation and inadequate income impact consumers’ ability to afford the essentials, reduce debt, and support their families, while others will have to resort to their savings to make ends meet. More than a quarter (26%) of consumers said they worry about their ability to save money for both expected (retirement) and unexpected (healthcare, long-term care) expenses. Less common fears include the broader economy, standard of living, and government policy. Three in 10 Americans say nothing about their financial situation “scares” them.

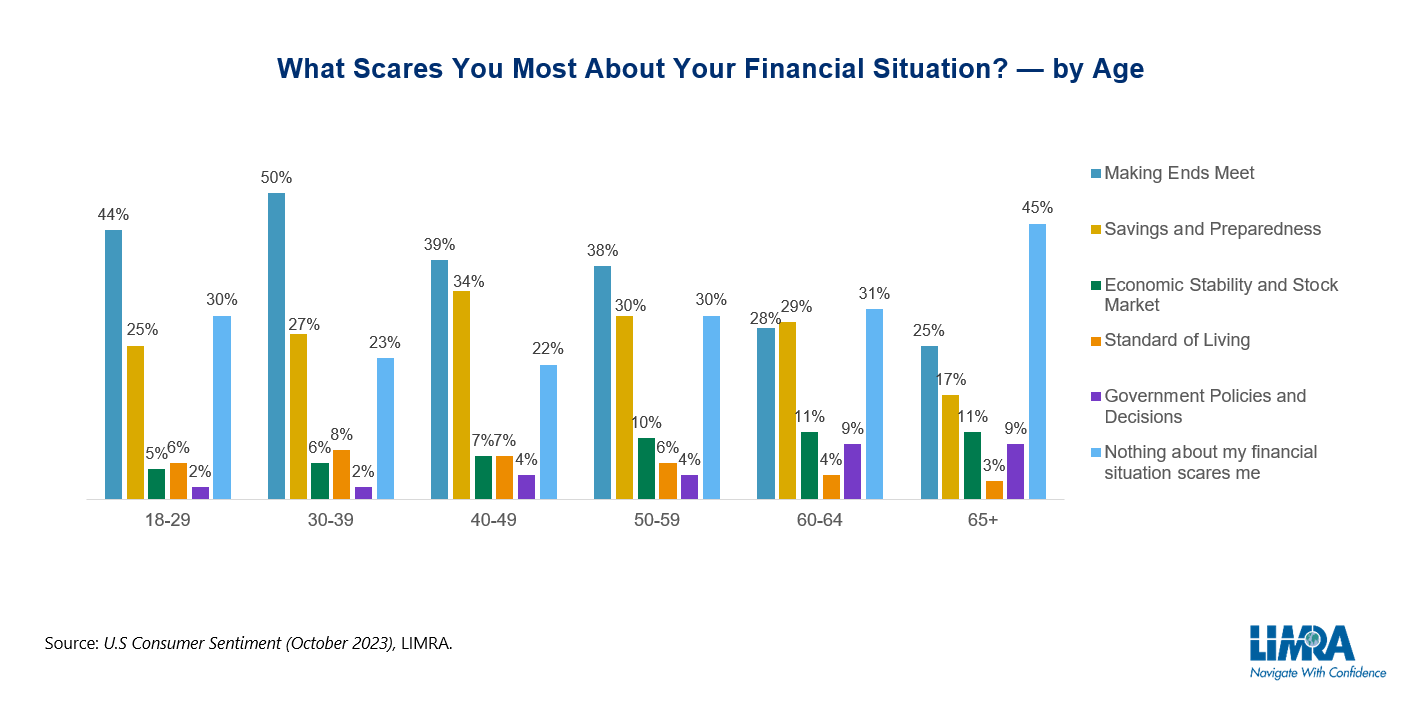

The data also show how one’s financial concerns change with age. Adults in their 20s and 30s typically struggle more than older adults with making ends meet, as they are more likely to have lower incomes. Adults in their 40s and 50s, however, will show higher concern around retirement saving and preparedness. Senior adults are more sensitive to government decisions on programs like Social Security and Medicare or anything that affects their investments.

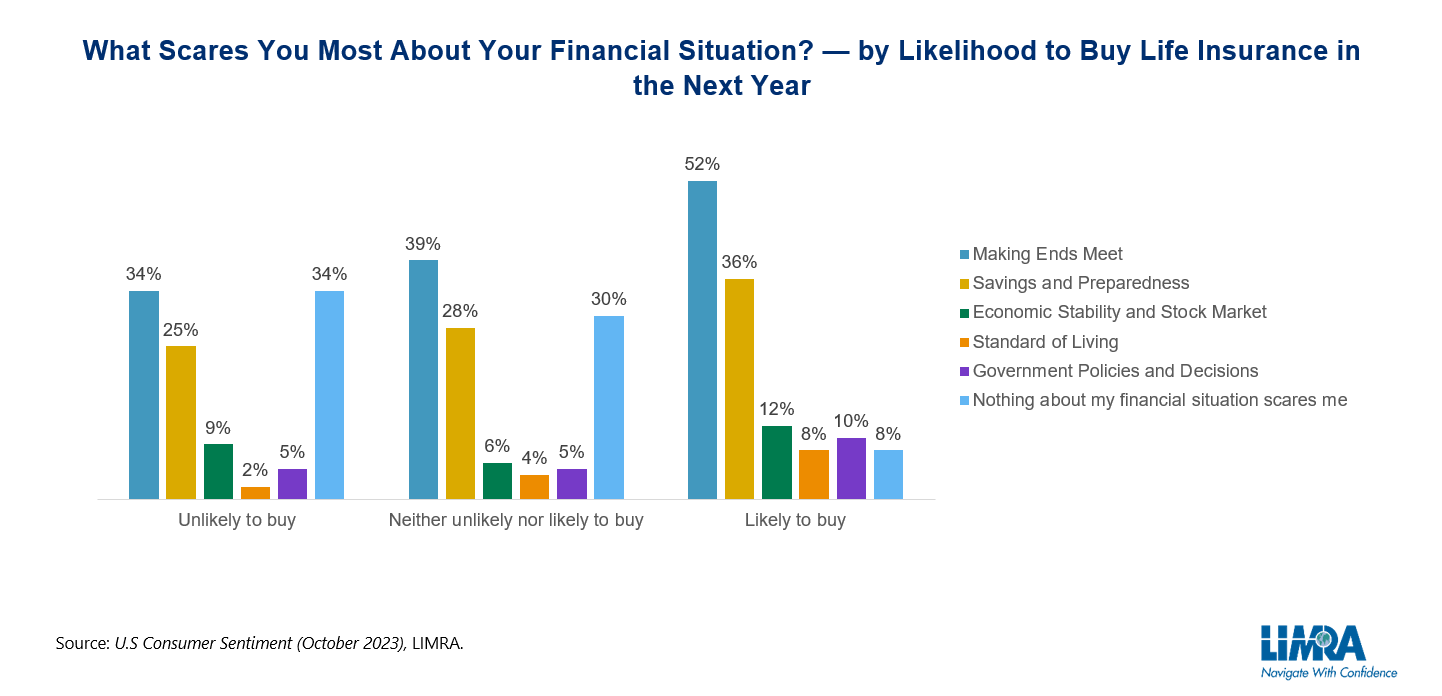

Unprompted, few consumers — just 5 in 3,000 respondents — mentioned the financial impact of their or a loved one’s death as something that scares them most. Nonetheless, financial fears — even urgent day-to-day hardships — do not entirely overshadow individuals’ interest in purchasing life insurance. In fact, respondents with other top-of-mind financial fears were more than 5 times as likely to express serious interest in buying life insurance in the next year — 17% compared to just 3% of people who say nothing about their finances scares them. (This difference isn’t because the latter group already has coverage.) The chart below illustrates the relationship another way: how people who appear the most interested in buying life insurance in the next year are the most likely to have (other) pressing financial fears.

LIMRA regularly finds consumers overstating their intentions to buy life insurance, so the metric is often described as more of an aspirational one. The current study suggests that financial fears likely act as both a motivator and an inhibitor to the purchase of life insurance.

The life insurance industry can offer some peace of mind to those who are the most interested in their products. Still, advisors and carriers must be attuned to the breadth of consumers’ biggest financial fears, spanning from immediate survival concerns to long-term uncertainties. By understanding and addressing diverse fears, the industry can offer tailored solutions that not only provide practical support but also leverage the pivotal role of life insurance in fostering financial resilience in an ever-changing economic landscape.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257