Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

9/18/2024

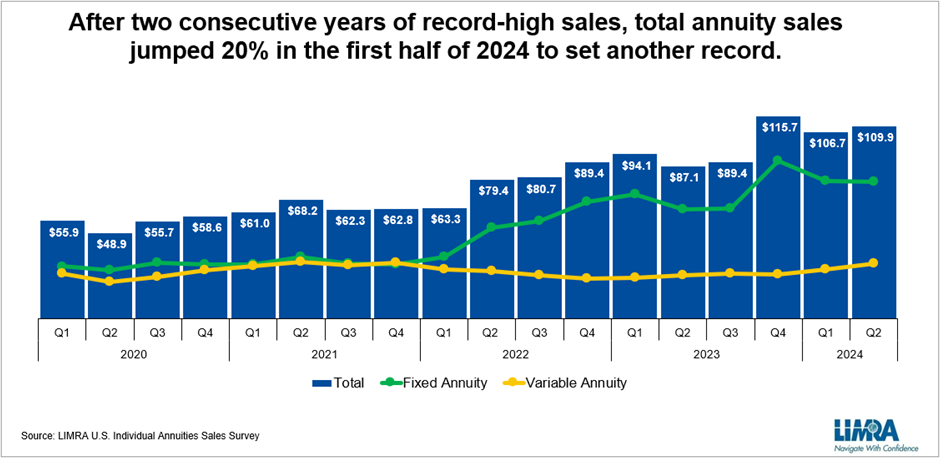

LIMRA recently announced sales of annuities jumped 20% to $216.6 billion in the first half of the year. This puts sales on pace to top $400 billion in 2024 and set a third annual sales record.

Total U.S. annuity sales have experienced double-digit growth for two consecutive years and LIMRA expects similar sale growth in 2024. LIMRA estimates that collectively from 2022 – 2024, annuity sales will exceed $1.1 trillion.

In a recent LinkedIn Live event, Bryan Hodgens, senior vice president and head of LIMRA research, and Keith Golembiewski, assistant vice president and director of LIMRA annuity research, discussed the product sales trends and factors that have spurred the record-setting annuity sales over the past two years.

Favorable economic conditions and demographic shifts have driven demand for investment protection and guaranteed lifetime income solutions that are unique to annuity products. During their discussion, Hodgens focused on the economic factors, such as higher interest rates and prolonged market volatility, which have enhanced the value and appeal of fixed annuity products, particularly fixed-rate deferred (FRD) and fixed indexed annuities (FIA).

Over the past two years, LIMRA research shows investors flocked to FRD annuities as the product’s crediting rates, on average, outpaced CD rates. Importantly, a LIMRA analysis of FRD sales finds nearly two thirds of the assets were new to the market, not exchanges. FRD sales have held nearly 40% of the total U.S. annuity market share for the past two years.

While the Federal Reserve has signaled its intent to cut interest rates in September and carriers have pulled back on crediting rates, LIMRA data shows sales of FRDs have not slowed. While LIMRA doesn’t expect FRD sales to match the record set in 2023, the results will be historically strong.

Fixed indexed annuities have also experienced record growth in 2022 and 2023, and that momentum has continued in 2024. In the first half of 2024, FIA sales jumped 23% to $59.3 billion. Interest rates clearly are making these products’ cap rate and participation rates competitive and marketable. Carriers are also continuing to innovate their FIA products, offering unique indices and features that resonate with investors and distribution. Most of the sales suggest interest in FIAs is expanding with more than 70% of sales reflecting organic market growth, not exchanges. Today, independent agents represent a majority of FIA sales, but independent broker dealers and full-service national broker dealers recorded more than 30% growth in year-over-year FIA sales so far this year.

Another big factor driving growth of fixed annuity sales is the shift in demographics. Golembiewski noted that there are more than 11,000 Americans turning 65 each day — representing at least 4.1 million annually through 2027. This ongoing influx of new retirees highlights why annuities are gaining attention.

While 72% of today’s retirees report that their households receive enough income from lifetime-guaranteed income sources to cover all of the household’s basic living expenses, pre-retirees are less confident in their retirement income prospects. Less than half (47%) of working adults ages 50–75 believe they will be able to cover basic living expenses in retirement with guaranteed income sources and a majority say they are interested in investing in an annuity to fill that gap. LIMRA research shows individual annuity product sales mainly cluster around the traditional retirement ages between 62 and 65.

Hodgens and Golembiewski then turned to what it will take to expand on the market growth witnessed since the pandemic. In late 2022, demand overwhelmed capacity when there was a surge in pending contracts because companies couldn’t process the business quickly enough. Golembiewski noted that carriers were adjusting their investments and hedging strategies to address capital constraints and looking at leveraging emerging technologies, like AI, to streamline processes for financial professionals and lower operational costs for carriers. In addition to improving efficiencies and productivity, this could attract financial professionals who have focused more on wealth management and are not actively selling annuities.

To watch the full conversation, visit How Do We Build On The Record-High Annuity Sales Momentum?

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257