Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

9/26/2024

Effectively engaging this market represents a big opportunity for the industry

Over the past decade, the Hispanic American market has grown 23% to 62 million, representing nearly 1 in 5 Americans. This market is projected to continue to grow substantially, reaching almost 82 million by 2040.

In addition to their growth in population, Hispanic Americans have made substantial gains in wealth. From 2013 to 2022, median inflation-adjusted wealth of Hispanic families in the U.S. more than tripled, from $18,000 to $62,000, with younger Hispanic generations reporting the biggest rise. Yet, life insurance ownership has not kept up.

The 2024 Insurance Barometer Study, by LIMRA and Life Happens, reveals only 43% of Hispanics report having life insurance coverage. This is the lowest ownership among any racial or ethnic group over the last decade. Additionally, most Hispanics (53%) say they need, or need more, life insurance protection — 11 points higher than the general population. Without proper life insurance coverage, many of these individuals would experience financial hardship should a loved one pass away unexpectedly. In fact, 46% of Hispanic families say they would face financial hardship within six months should the primary wage-earner die unexpectedly.

So, what’s keeping Hispanics from getting life insurance?

LIMRA’s research suggests lack of knowledge plays an oversized role for Hispanics, as it does in other markets.

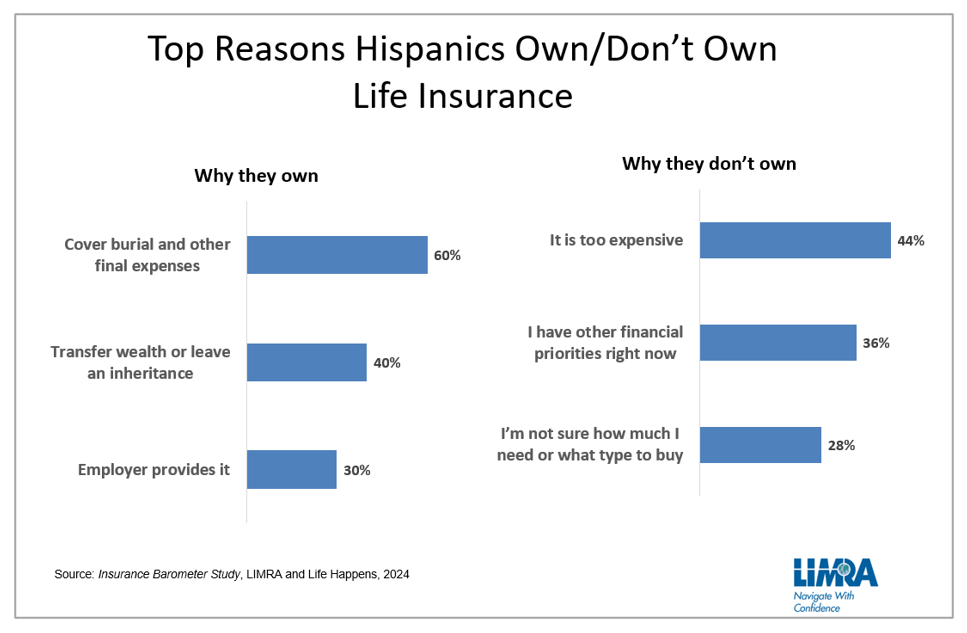

Many Hispanics perceive the cost of life insurance to be well above the actual cost. The study shows that more than 4 in 10 (44%) of Hispanic Americans feel life insurance is too expensive. Yet more than 7 in 10 Hispanics (72%) overestimate the cost of a term life insurance policy. In addition, 26% of Hispanics feel that life insurance coverage is only for covering final expenses, possibly undervaluing the financial protection life insurance can offer.

Hispanics also have competing financial priorities with almost half (48%) expressing concern about having enough money for a comfortable retirement. More than 4 in 10 (44%) of Hispanics are worried about both being able to save money for an emergency fund and being able to support themselves if they are unable to work due to a disabling illness or injury.

Another common misconception regarding the Hispanic population is about access. Twelve percent of Hispanics who do not own (or own enough) life insurance say they would not qualify for coverage. This is almost double what White Americans and Black Americans (7% and 6% respectively) say.

Having a financial professional can help people determine what and how much life insurance to purchase. Hispanics, however, are more distrustful of life insurance agents and carriers than the general population. Just 34% are currently working with a financial professional. Now is the time for the industry to build trust with this community and help them make informed and educated decisions, encourage confidence in their future financial security, and ensure their loved ones are protected if the unexpected happens.

Having a financial professional can help people determine what and how much life insurance to purchase. Hispanics, however, are more distrustful of life insurance agents and carriers than the general population. Just 34% are currently working with a financial professional. Now is the time for the industry to build trust with this community and help them make informed and educated decisions, encourage confidence in their future financial security, and ensure their loved ones are protected if the unexpected happens.

Every year across America communities gather to celebrate National Hispanic Heritage Month, which is observed from Sept. 15 to Oct. 15. This recognition is designed to honor the contributions and influence of Hispanic Americans to the history, culture and achievements of the United States.

For more information about the Hispanic insurance market, see Securing Hispanics’ Financial Security Through Life Insurance.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257