Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

5/30/2024

LIMRA research shows 7 in 10 workers are interested in guaranteed income products

Facing the potential of more than 25 years in retirement, many of today’s workers worry about running out of money. While half of retirees enjoy guaranteed lifetime retirement income from a pension, just 15% of current private-sector workers have access to a defined benefit (pension) plan. Thanks to the SECURE Act, more employers are interested in offering workers the option to invest in lifetime annuity products within their 401(k)s, creating a pension-like income in their future retirement.

Facing the potential of more than 25 years in retirement, many of today’s workers worry about running out of money. While half of retirees enjoy guaranteed lifetime retirement income from a pension, just 15% of current private-sector workers have access to a defined benefit (pension) plan. Thanks to the SECURE Act, more employers are interested in offering workers the option to invest in lifetime annuity products within their 401(k)s, creating a pension-like income in their future retirement.

“The idea of a guaranteed income product in a defined contribution plan has been around for years. Up until recently, however, plan sponsors have been a little reluctant to put annuities inside of a 401(k) plan,” said Bryan Hodgens, head of LIMRA research. “The Secure Act removed some of the obstacles that had deterred plan sponsors from adopting these products and now we are beginning to see growth and momentum in this market.”

However, this trend may be changing. According to recent LIMRA research, more than 4 in 10 plan sponsors say they are either actively considering or have decided to add an in-plan annuity within their retirement savings plan.

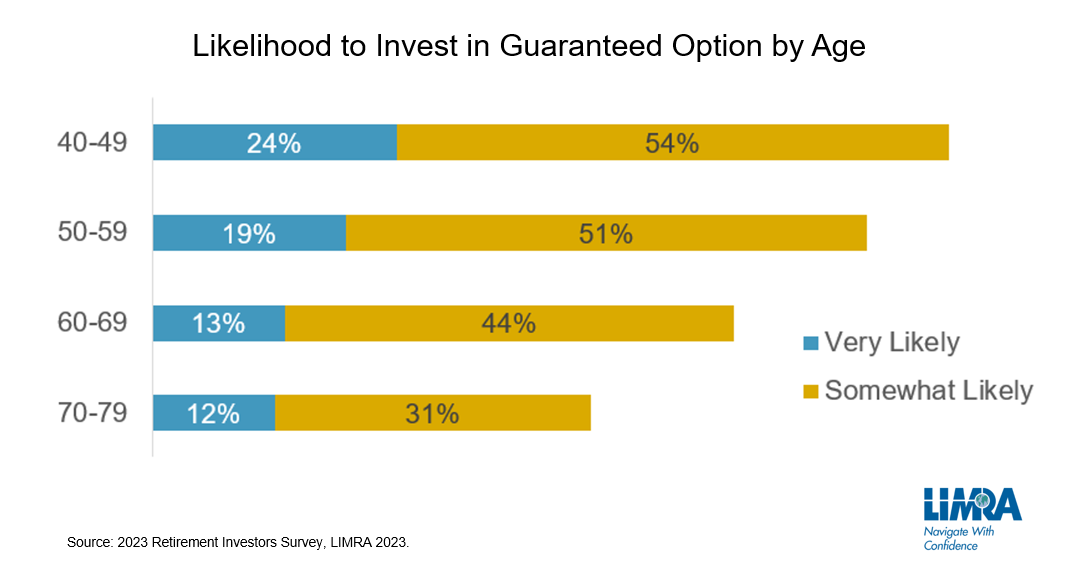

Interest is strong among workers, too. LIMRA asked Americans between the ages of 40 and 80 with at least $100,000 in investable assets how likely they would be to invest in guaranteed income within their retirement plan. Nearly 7 in 10 non-retired workers say they would be “very” or “somewhat” likely to select an in-plan annuity option if it were available. Younger participants (between the ages of 40 and 49) are especially interested in this option.

While a majority of plan participants are interested in in-plan annuity options, some employers are hesitant to offer them. Plan sponsors who say they are unlikely to add one say the products are expensive, complicated, resource-intensive, hard to explain, not flexible and not portable.

While there is still work to be done, many of these perceived obstacles are being addressed through technology. Middleware companies have helped with the portability, liquidity and the movement of money between the plan and the record keepers. And record keepers have also been investing in technology enhancements to their platforms to add these products.

What Spurs Interested Plan Sponsors to Act

There could be many reasons for an employer to decide to add an in-plan annuity to its DC plan. According to LIMRA research, the top four reasons are that they:

The study shows plan sponsors that offer in-plan annuities clearly feel they can help their retiring employees to generate sustainable income and are often willing to explicitly recommend them to employees. Yet these employers also feel that in-plan annuities are not for everyone.

“Perhaps, given their complexity, in-plan annuities are not seen as a priority for employees beginning their careers, for whom rapid accumulation is the main goal. Employers with especially young employee bases may therefore be more circumspect in making broad recommendations to participate,” Hodgens notes. “That said, two-thirds (64%) of Gen Z and Millennials are interested in contributing to an in-plan annuity.”

Our industry needs to help employers understand that younger workers know the value of investing in guaranteed income solutions while they accumulate assets. For in-plan annuities to truly take off, the industry needs to educate advisors and employers about how they work and the potential benefit of providing guaranteed income to workers who no longer have the option of a traditional pension plan.

To learn more about in-plan annuities, watch May’s LinkedIn Live episode of Industry Insights With Bryan Hodgens.

LIMRA members can learn more about the in-plan annuity market by visiting: Powering Forward: In-Plan Annuities Gain Momentum.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257