Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

9/3/2024

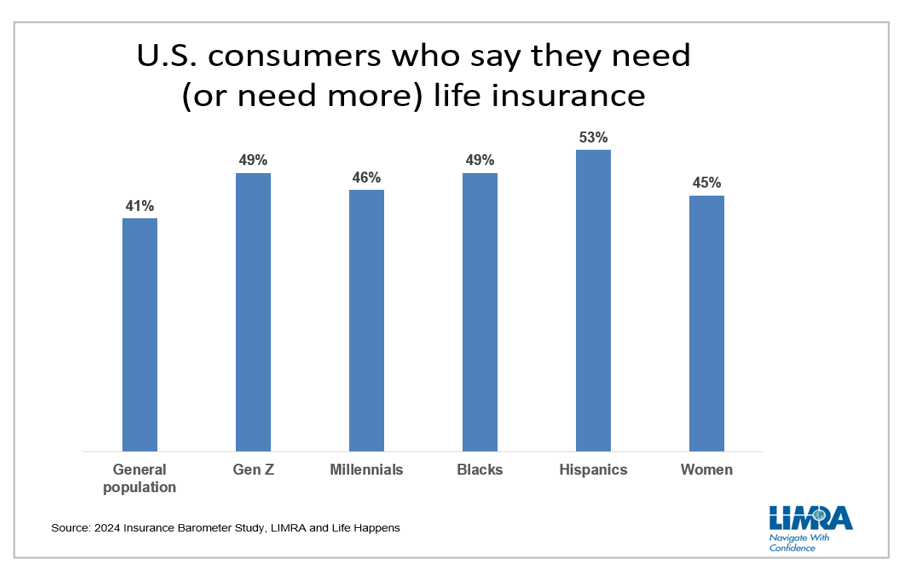

While people continue to acknowledge the importance of life insurance — 70% say they know they should have coverage — just half of U.S. adults report owning it and many more say they don’t have enough coverage to protect their loved ones. According to the 2024 Insurance Barometer Study a record-high proportion of U.S. adults (42%) — representing 102 million people — say they need (or need more) life insurance.

The need is greater for specific market segments. Young adults, women, Hispanics, and Blacks express the greatest need for life insurance.

Why Don’t They Buy?

Consumers’ biggest obstacles about buying life insurance are due to a lack of knowledge and misconceptions about the products and process. Just a quarter of consumers feel confident in their knowledge of life insurance. Many who are uninsured or underinsured say they don’t know what or how much they need, which often leads to procrastination.

The number one reason consumers give for not purchasing the life insurance they need is that it’s too expensive. Yet, since the first annual study was conducted in 2011, consumers have consistently overestimated the cost of life insurance. The most recent study shows about three-quarters (72%) of Americans overestimate the true cost of a basic term life insurance policy. There are few other products on the market today that consumers overestimate the cost by such a wide margin.

When asked how people come up with their life insurance cost estimate, more than half (54%) said it was based on “gut instinct” or a “wild guess.”

These statistics are important because the study revealed that nearly half of U.S. consumers say they would face financial hardship within six months if the primary wage earner were to pass away unexpectedly.

This month marks Life Insurance Awareness Month (LIAM) — the perfect opportunity to dispel misconceptions and educate the many Americans who live with a life insurance coverage gap. Together, we can help them get the life insurance they need to protect their families and achieve financial security.

LIMRA recently launched its LIAM page, which includes resources that provide insights about what’s impacting life insurance ownership in 2024 and the vital role life insurance can play in providing financial security.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257