Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

11/7/2024

The Department of Health and Human Services estimates that 70% of Americans over age 65 will need long-term care (LTC) services within their lifetime.1 With an average cost of over $5,000 a month, not having long-term care insurance coverage could severely compromise a retiree’s financial security.

November is National Long-Term Care Awareness Month. Financial professionals should take this opportunity to encourage clients to think about their long-term care planning if or when they require care. Here are five reasons to discuss life combination products with your clients.

Reason 1: Consumers lack understanding of long-term care insurance.

Historically, consumers often overestimate how much long-term care insurance (LTCI) they actually have. According to LIMRA data, 29% of consumers believe they own some form of LTCI coverage (either standalone or a combination product). LIMRA estimates just 3% to 4% of adults over age 50 have some sort of long-term care insurance to mitigate the LTC expenses.

Many consumers mistakenly think their health insurance or Medicaid will cover their LTC services when that might not be true. Medicaid coverages vary on a state-by-state basis, are limited to certain services, and may require consumers to spend down their assets to qualify for coverage. These misconceptions could cost consumers greatly if they are unprepared.

Reason 2: Life combination products could cover long-term care expenses more affordably.

The cost and availability of standalone LTCI care often deter people. More than 1 in 4 (27%) consumers say that a standalone long-term care insurance policy is too expensive. But LIMRA data suggests life combination products that provide LTC could be a more attractive option for many consumers. Over one quarter (26%) of American consumers would be extremely or very likely to consider purchasing life combination products — a 7-percentage point increase from 2019, according to LIMRA data.

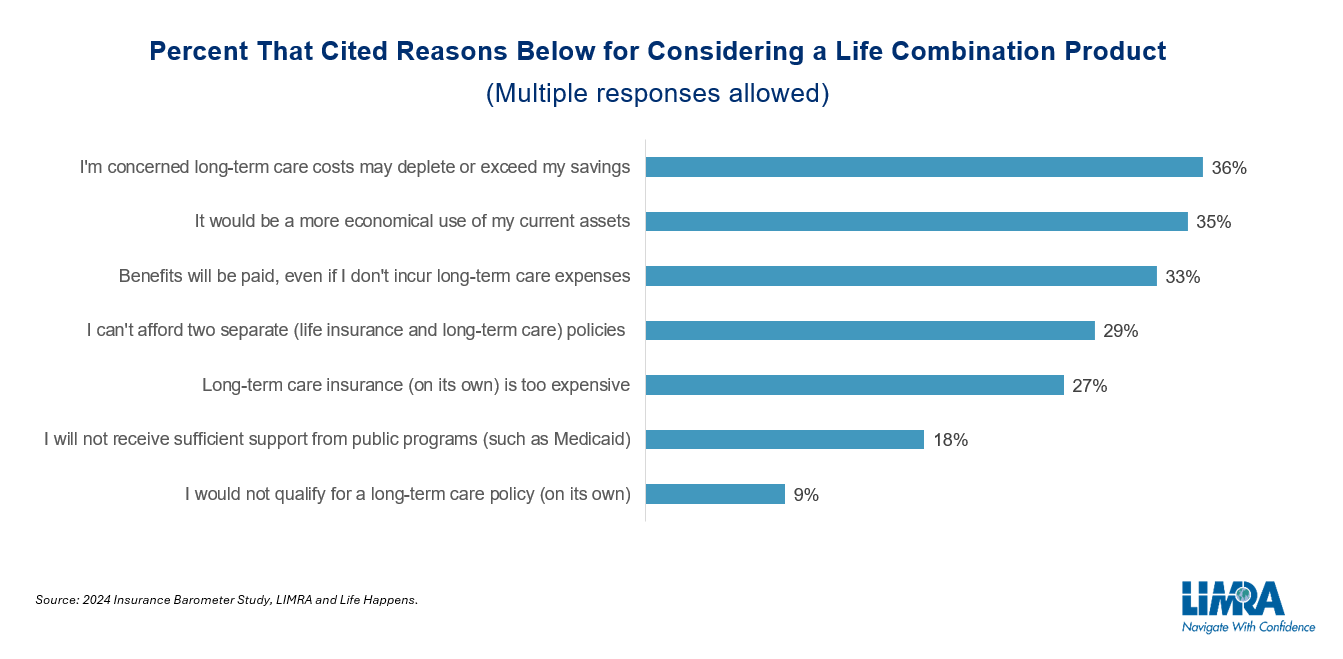

LIMRA data shows that 36% of consumers would consider a life combination product because they’re concerned that LTC expenses may deplete or exceed their savings. Thirty-five percent of consumers also believe that a life combination product would be a more economical use of their assets, and 33% say their benefits will still be paid even if they don’t incur long-term expenses.

Reason 3: Younger adults are more likely to consider combination products than older generations.

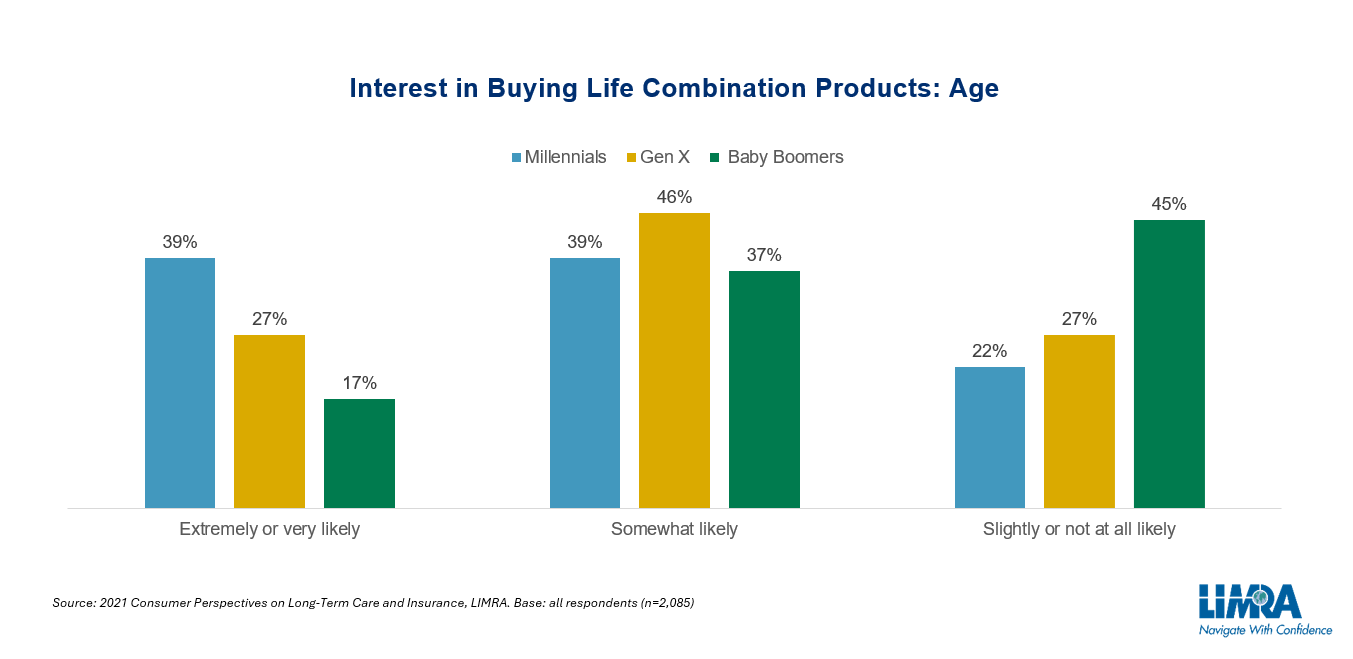

LIMRA data suggests that interest in life combination products is high among Millennials. The 2024 Insurance Barometer Study from LIMRA and Life Happens shows that almost 4 in 10 (39%) Millennials are very likely to consider buying a life combination product compared to 27% of Gen X and 17% of Baby Boomers.

Whereas older adults may expect Medicaid to cover their long-term care, Millennials are more likely to view a life combination product as a one-stop shop to secure both life coverage and long-term care insurance.

Reason 4: Combination products are attractive to caregivers with high stress.

According to the Department of Health and Human Services, an estimated 80% of care received at home is provided by an unpaid caregiver such as a family member or friend.2 Caregivers typically provide both medical and non-medical services and can also have intense responsibilities including assisting with eating, bathing, or dressing.

Providing these services can lead to stress and burnout. The National Library of Medicine reports that 38% of family caregivers experience a moderate to high degree of financial strain from providing care.3 Financial professionals can discuss the peace of mind that life combination products can provide by covering the caregiver’s own long-term needs should their health decline.

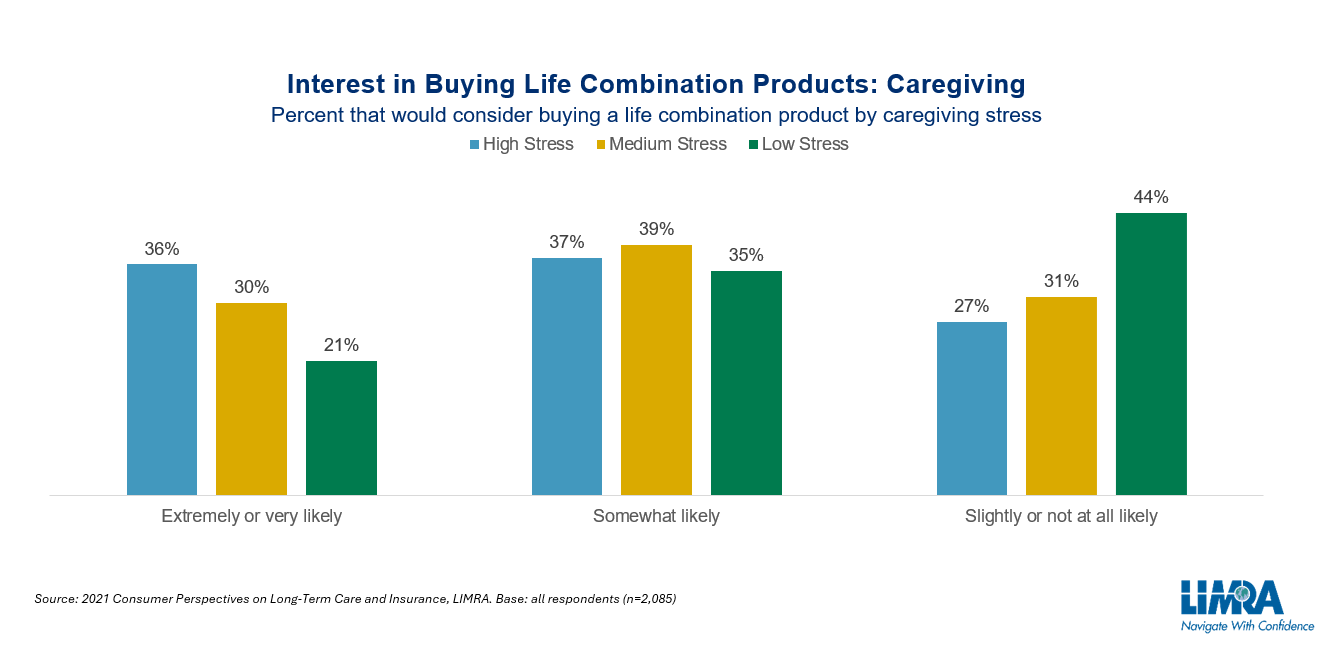

Thirty-six percent of caregivers with high stress would be extremely or very likely to purchase a combination product according to LIMRA, compared to 30% of caregivers with medium stress and 21% of caregivers with low stress.

Reason 5: The array of LTCI solutions can also offer consumers the choice of where they want to receive care.

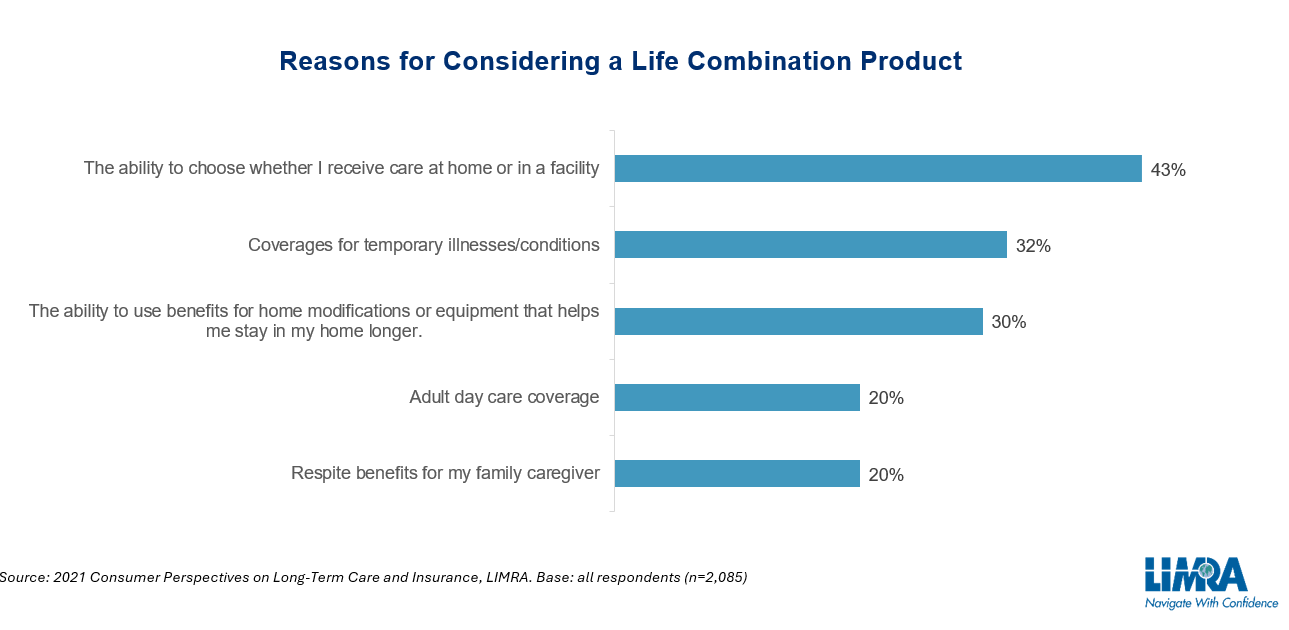

Forty-three percent of consumers say, when considering purchasing a life combination product, that they value the ability to choose where they receive care either at home or in a facility. Along with being a more affordable option for LTC planning, a life combination product could allow consumers the freedom to remain in their homes longer while they receive care. Three in 10 consumers said they liked the ability to use benefits for home modifications or equipment that will allow them to remain in their homes longer.

Additionally, 32% of consumers value the coverage for temporary illnesses or conditions, while 2 in 10 consumers like the ability to use the benefits to cover adult day care services and provide respite benefits for their family caregiver.

While long-term care can take a toll both emotionally and financially, effective planning can help mitigate that burden. This Long-Term Care Awareness Month, encourage your clients to think about long-term care planning and the possible role that life combination products could play in providing peace of mind.

Join the conversation on social media by sharing these free animated social media posts:

Click to download animated social media posts.

1Caregiver Resources & Long-Term Care, U.S. Department of Health and Human Services.

2Ibid.

32020 Caregiver Health and Well-Being, and Financial Strain, National Library of Medicine.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257