Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

6/5/2024

June is Pride Month, an opportunity for the industry to help LGBTQ+ consumers achieve financial security

While lesbian, gay, bisexual, transgender, and queer or questioning (LGBTQ+) people have attained greater equality and protections over the past decade, they still face unique challenges, including financial ones. New LIMRA research shows how these financial worries often deter LGBTQ+ consumers from obtaining the life insurance they need.

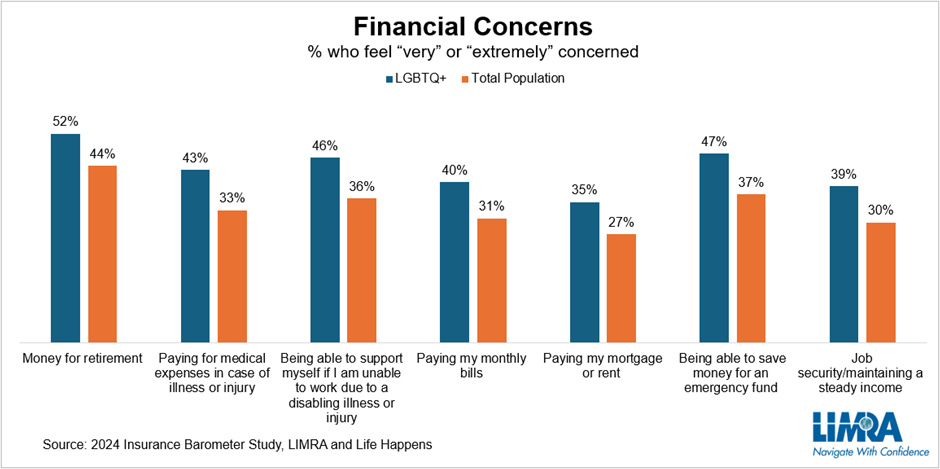

According to the 2024 Insurance Barometer Study, conducted by LIMRA and Life Happens, LGBTQ+ consumers are more likely than the general population to express financial concerns about immediate issues such as maintaining their jobs, paying monthly bills and mortgages, and future risks such as becoming disabled, saving for retirement or having an emergency fund. Even looking at a comparison with younger generations, LGBTQ+ consumers express greater financial worry.

One of the biggest obstacles for all uninsured and underinsured U.S. adults is competing financial priorities and concerns. This is true for LGBTQ+ consumers as well. While the LGBTQ+ adult community is very diverse in terms of age, wealth, gender, and ethnicity, LIMRA research shows this group is disproportionally uninsured and underinsured, leaving those who rely on them at financial risk should they die unexpectedly.

Just 40% of LGBTQ+ adults say they own life insurance, which is a considerably lower than the general population (51%). Even those who have life insurance coverage may not have enough. LIMRA research shows 46% of LGBTQ+ consumers — representing 8 million adults — say they need (or need more) life insurance.

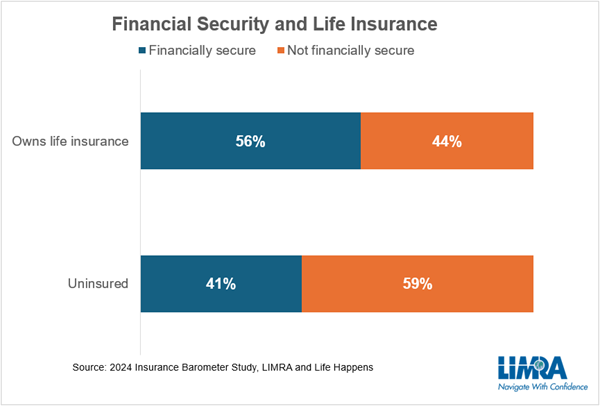

By boosting life insurance coverage with this group, the industry could help alleviate some of their long-term financial worries and help build a sense of financial security. The Barometer study finds LGBTQ+ consumers who own life insurance feel more financially secure than uninsured individuals. Almost 6 in 10 insured LGBTQ+ adults feel financially secure, compared with just 41% of uninsured LGBTQ+ adults.

It is clear from this research that while this group is less likely to have adequate life insurance coverage, it doesn’t mean they don’t recognize its value. More than a third (34%) say they intend to purchase coverage in 2024.

Why Don’t They Buy?

Similar to the general population, lack of knowledge and misconceptions about life insurance are big factors in why people put off getting the coverage they need:

Financial Professionals Can Help

Lack of knowledge can often be addressed by working with a financial professional but less than a third (31%) of LGBTQ+ adults say they currently work with one.

The good news is more than a third (34%) of LGBTQ+ consumers say they are looking for a financial advisor to work with. The top three factors LGBTQ+ consumers consider when choosing an advisor are trustworthiness, experience and communication skills. Financial professionals seeking to work with LGBTQ+ consumers should be aware this group has often faced discrimination or negative feedback in other aspects of their lives and may feel wary of engaging financial professionals for fear of being judged. It is critical that carriers and financial professionals create a welcoming and inclusive environment to overcome any existing barriers and establish trust.

As our nation celebrates Pride Month, our industry should raise awareness among LGBTQ+ individuals and all Americans about the need for products like life insurance and disability income insurance that can provide financial security for themselves and their loved ones.

-end-

*For a healthy, non-smoking 30-year-old male, a $250,000 20-year term-life policy is about $200 a year or less than $4.00 a week. (Source: 2024 Insurance Barometer Study, LIMRA and Life Happens)

Get social with us this PRIDE Month:

Educate and engage your consumers this month with our social media factoids. Download below:

To download the animated content, click the share icon on the bottom right and then select "download":

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257