Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

10/22/2024

For more than 60 years, LIMRA has been tracking life insurance ownership in the U.S. Much has changed over that time. LIMRA went from talking with consumers across the kitchen table to engaging consumers on computers and mobile devices to learn about what kinds of life insurance protection families had.

On top of the impact of technology, LIMRA’s most recent ownership study has uncovered many other changes that have impacted people’s awareness and perceptions about life insurance. Understanding these shifts is necessary to inform how the industry effectively engages today’s consumers.

The Latest Results

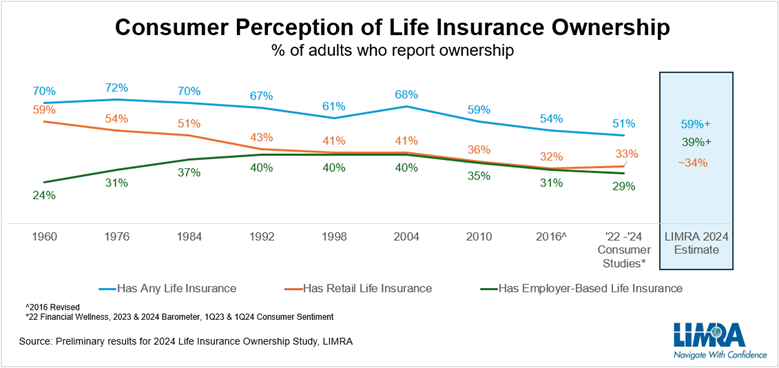

Today, LIMRA conservatively estimates that 59% of American adults own life insurance. Previous ownership studies relied solely on consumer surveys to determine aggregate life insurance coverage in the U.S. However, recent discrepancies between consumers’ self-reported data and industry data have prompted LIMRA to adjust its methodology. Now, it considers the consumer perspective along with other LIMRA, industry, and government data to estimate the rate of ownership.

A significant part of this discrepancy is driven by decreasing awareness of workplace coverage. Over the years, LIMRA noted that with the expansion of employer-sponsored benefits, many workers have become less aware or unsure of their workplace benefits. Today, LIMRA estimates that one in three employees with life insurance coverage at work— most of which is employer-paid — are not fully aware of this benefit.

As a result, while just 29% of all American adults reported they had life insurance coverage through an employer, workplace benefits participation rates and in-force data suggests it is much higher. LIMRA estimates the true workplace life insurance coverage rate is at least 39%.

On the retail side, consumers’ self-reported ownership is much more accurate. For someone to have retail life insurance coverage, they have to take proactive steps like buying a policy and paying premiums. In contrast, most workers with employer-paid life insurance coverage don’t have to take active steps to obtain coverage beyond being employed. This passivity leads to lack of awareness.

Although consumer awareness of retail life insurance ownership is higher, LIMRA’s study shows that there has been a significant decline in ownership over the past six decades. Today, LIMRA estimates retail life insurance ownership is approximately 34%.

There are a number of reasons that has led to this decline.

- There are greater financial demands on consumers’ plates and life insurance tends not to be a top priority. Thirty-six percent of consumers say they haven’t bought life insurance because they have other financial concerns. In addition, nearly half say they think life insurance is too expensive, although 72% overestimate the costs. There is a critical need to educate consumers about the important and unique role life insurance plays in achieving a family’s future financial security.

- The demographics have changed. Not only is the U.S. a far more diverse population, but the dynamics within households has changed as well. There are fewer traditional households, while single-parent households, single and divorced households have increased. There also are more women in the workforce and contributing to their household income, yet women are far less likely to have the coverage they need. Younger adults are getting married or having/adopting children later and putting off buying homes. All of which are key drivers for consumers purchasing life insurance. In light of these changes, the messages and methods of communicating with consumers must evolve as well. The 2024 Insurance Barometer Study finds a majority of Americans seek information about financial products on social media. Building robust and engaging content for the various audiences appropriate to the different platforms is especially important.

- There are significantly more financial product options for consumers. In the 1960s life insurance was one of the few financial instruments available broadly to Americans. Today, consumers have much more access and options to invest their money, including defined contribution plans, annuities, individual retirement account, stocks, and 529 plans (for education). While the options are greater, people struggle to save. According to a recent Bankrate study, more than 1 in 3 workers (34 percent) are living paycheck to paycheck and are unable to save for the future.

To compete in this crowded market, life insurers should not only tout financial security associated with providing for loved ones in the event of an untimely death, but also the tax-advantaged savings benefits associated with permanent life insurance products.

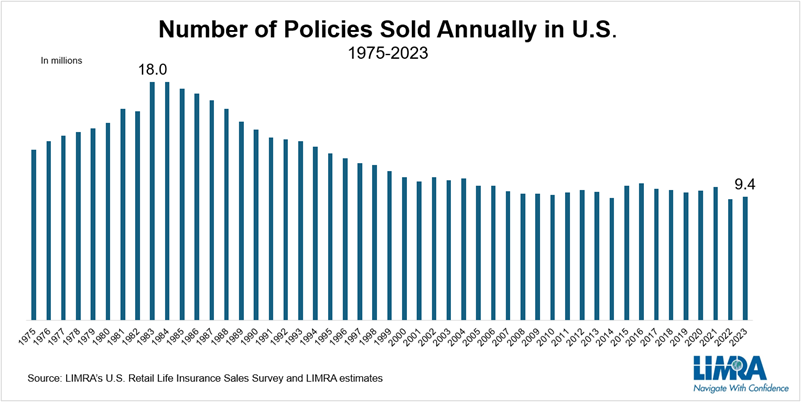

- Life insurance distribution has not kept up with population growth. LIMRA’s life insurance sales benchmark study shows there has been a significant decline in the number of policies sold annually over the past several decades.

While the population has grown by half since the 1980s, the number of life insurance sales professionals has remained relatively stagnant. LIMRA research shows although consumers say they want online options to purchase life insurance, most ultimately want to speak to an expert to ensure they are making the right choice. Identifying ways to expand distribution or using new technologies to improve existing distribution productivity are an imperative to address the growing life insurance coverage gap in the U.S.

Despite the obstacles and misconceptions, LIMRA research consistently shows that consumers recognize the value of life insurance. Seven in 10 Americans believe they need life insurance. Life insurers will have to continue to adapt and evolve to engage today’s consumer to fulfill its mission to protect families while growing their businesses.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834