Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

10/10/2024

Future retirees face a different landscape than current retirees. Access to pensions has declined over the past two decades. LIMRA research finds pre-retirees expect personal savings (401(k)s, IRAs, and other savings) to surpass Social Security as the main source of retirement income within the next 10 years. This means future retirees need to be more self-reliant and suggests formal retirement planning will be more important than ever before.

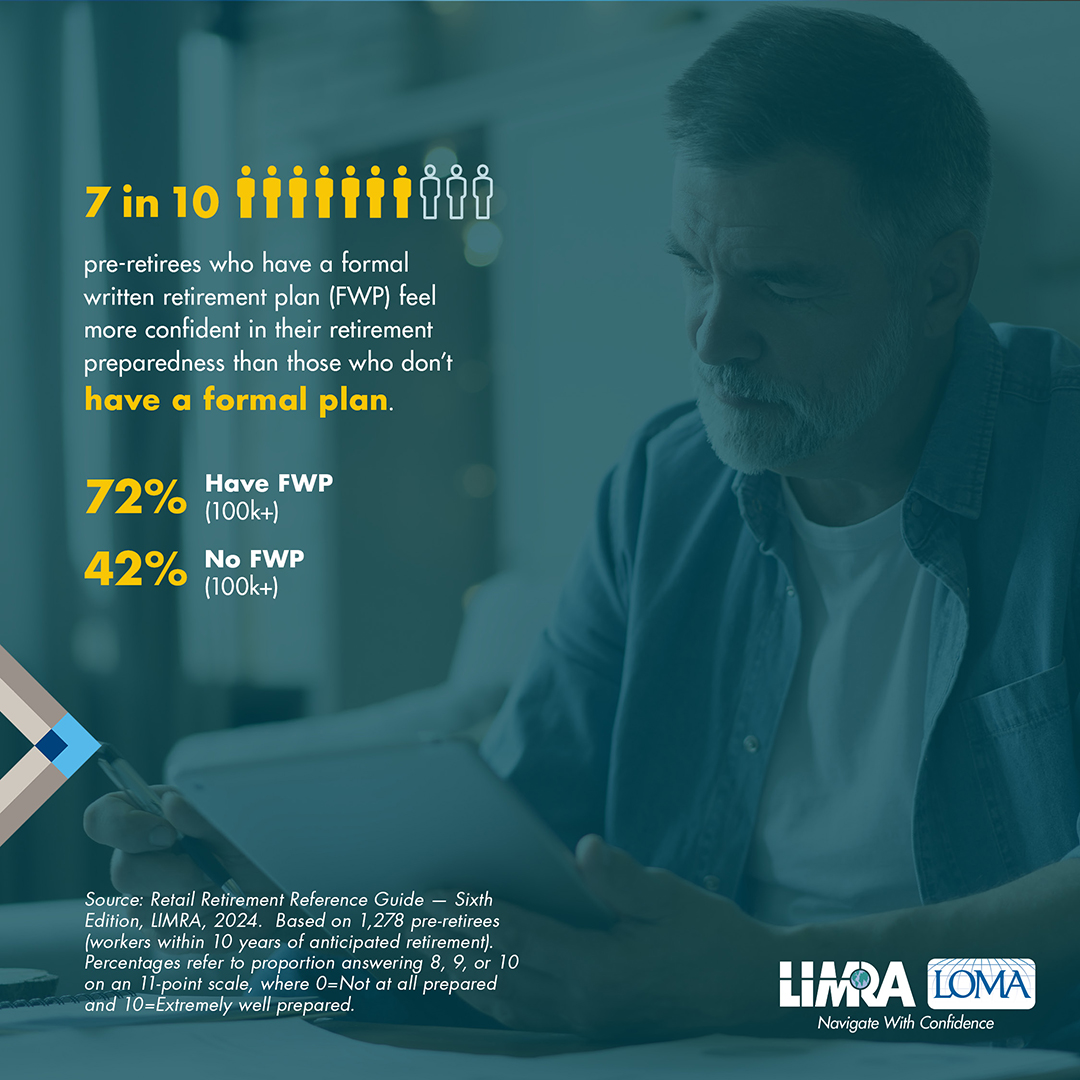

October is National Retirement Security Month, a time to encourage consumers nearing retirement to take actionable steps toward their future financial security. One of the best ways to accomplish this is by creating a formal written retirement plan. According to LIMRA’s newest edition of the Retail Retirement Reference Guide, those with formal retirement plans are more likely than those who don’t to say they are well prepared for their retirement goals (71% versus 29%, respectively).

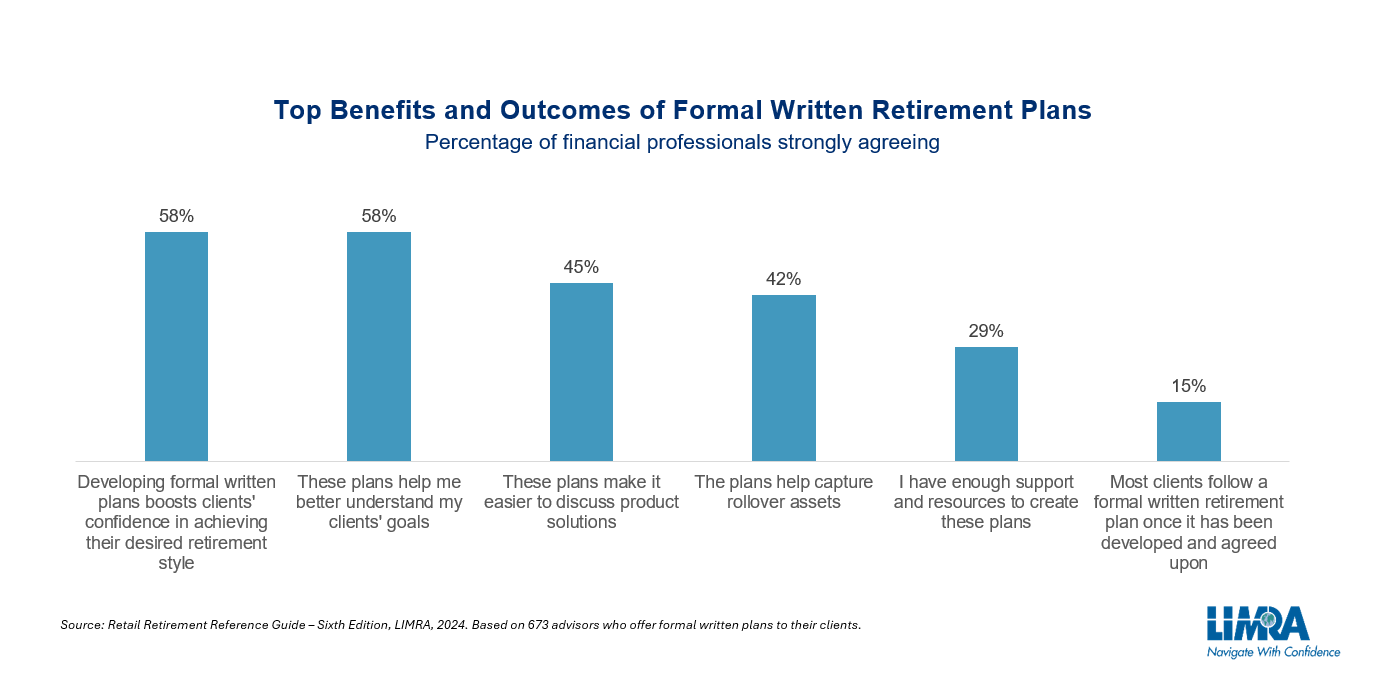

Having a formal written plan not only benefits investors, but also the financial professionals who work with them. LIMRA data shows that helping clients with creating a formal written plan could help contribute significantly to their books of business. The main benefits cited by 6 in 10 financial professionals are that their clients feel more confident about their retirement security and that they better understand their client’s goals.

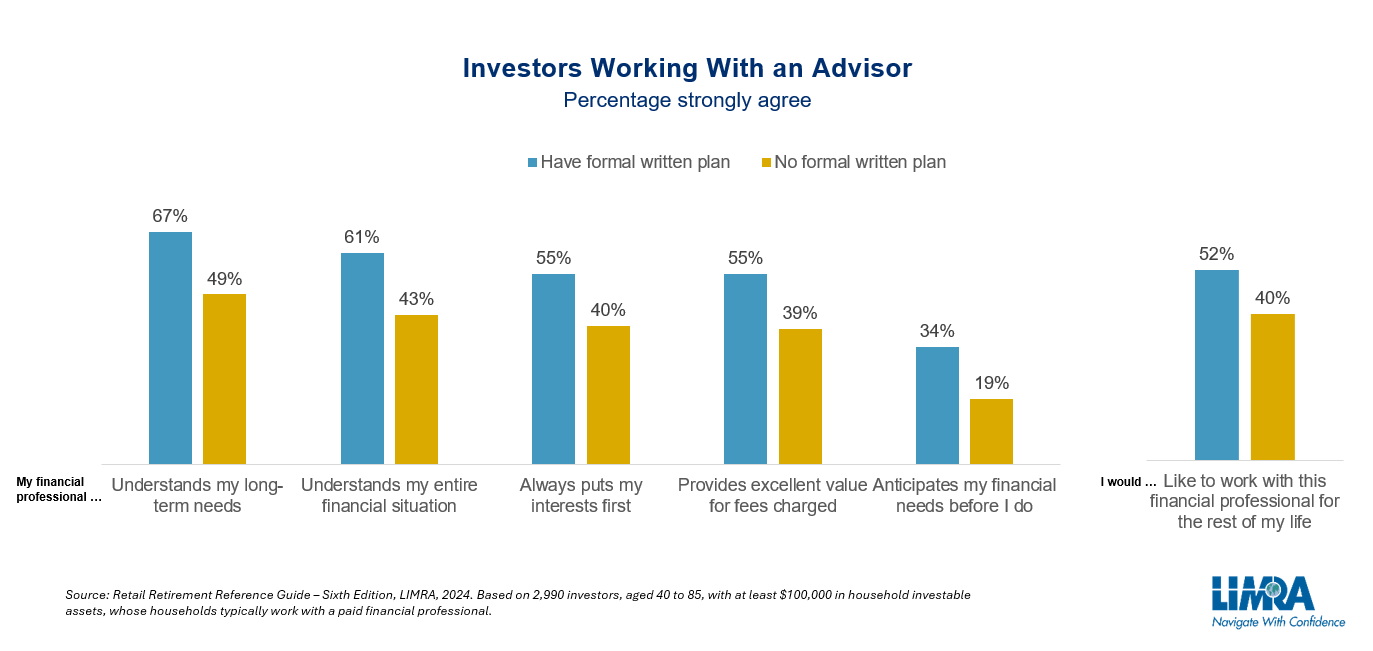

Clients themselves would agree. Investors (ages 40 – 85 with at least $100,000 in household investable assets) who have a formal written plan strongly agree that their financial professionals understand their long-term needs (67%) and entire financial situations (61%) compared with investors who do not have plans (49% and 43% respectively). Furthermore, clients with a formal written plan are more likely to want to stick with the same financial professional for the rest of their lives (52%).

Financial professionals who take the time to help their clients create a formal written plan benefit from strengthened client relationships and a more loyal client base.

Additionally, LIMRA data suggests that helping a client with a formal written retirement plan could also lead to future discussions about other product solutions, such as annuities. At least 25% of clients go on to purchase insurance or investment products when implemented in a formal plan. Among annuity owners with a formal written plan, about two thirds of them purchased annuities as part of their plan.

On average, 3 in 4 financial professionals spend between 2 and 8 hours completing each formal written plan. Yet, the time invested seems worthwhile as clients appreciate the professional advice. Six in 10 retirees and pre-retirees say they would be willing to pay $100 or more for a comprehensive analysis of their financial situation, including what is needed to save for retirement and where to invest their savings.

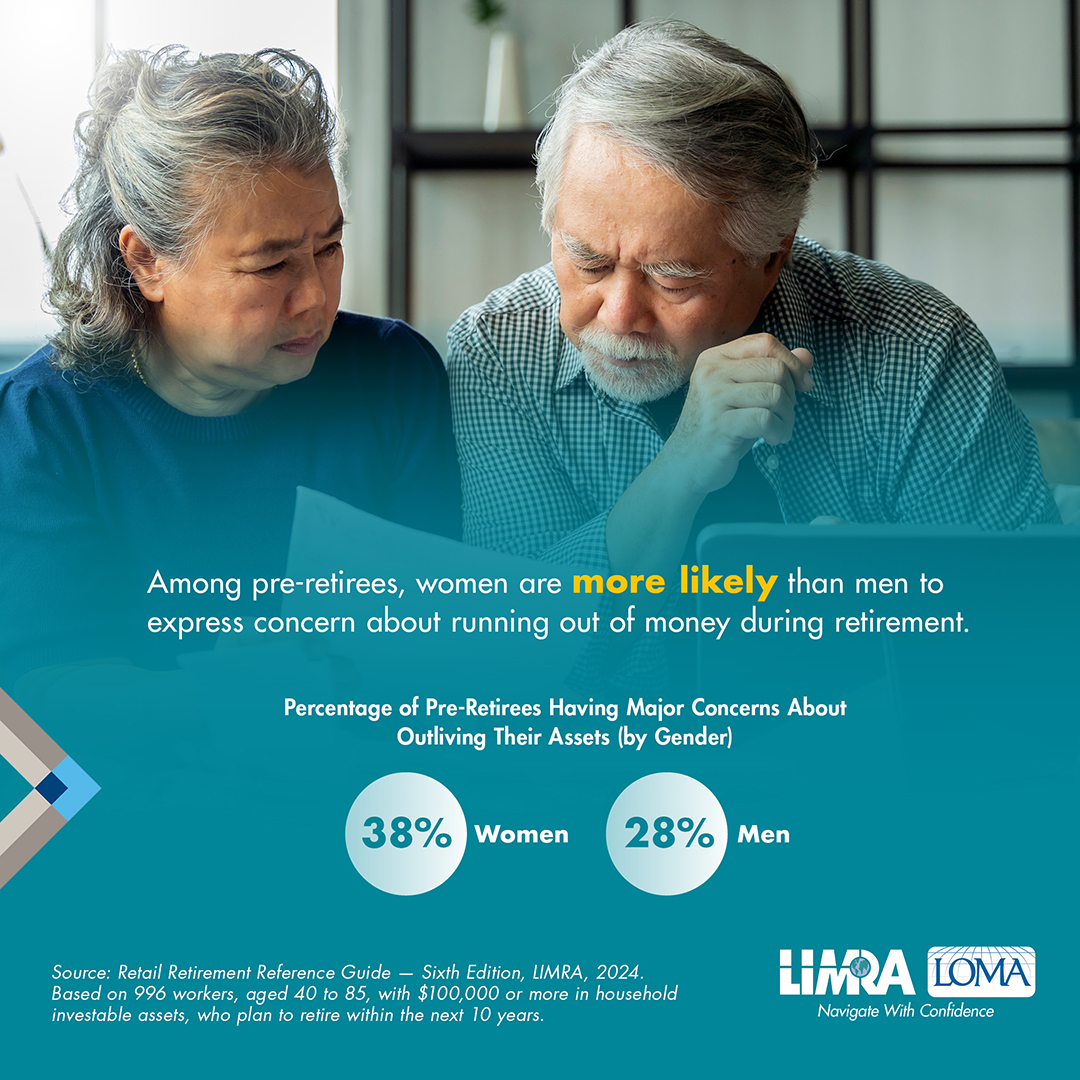

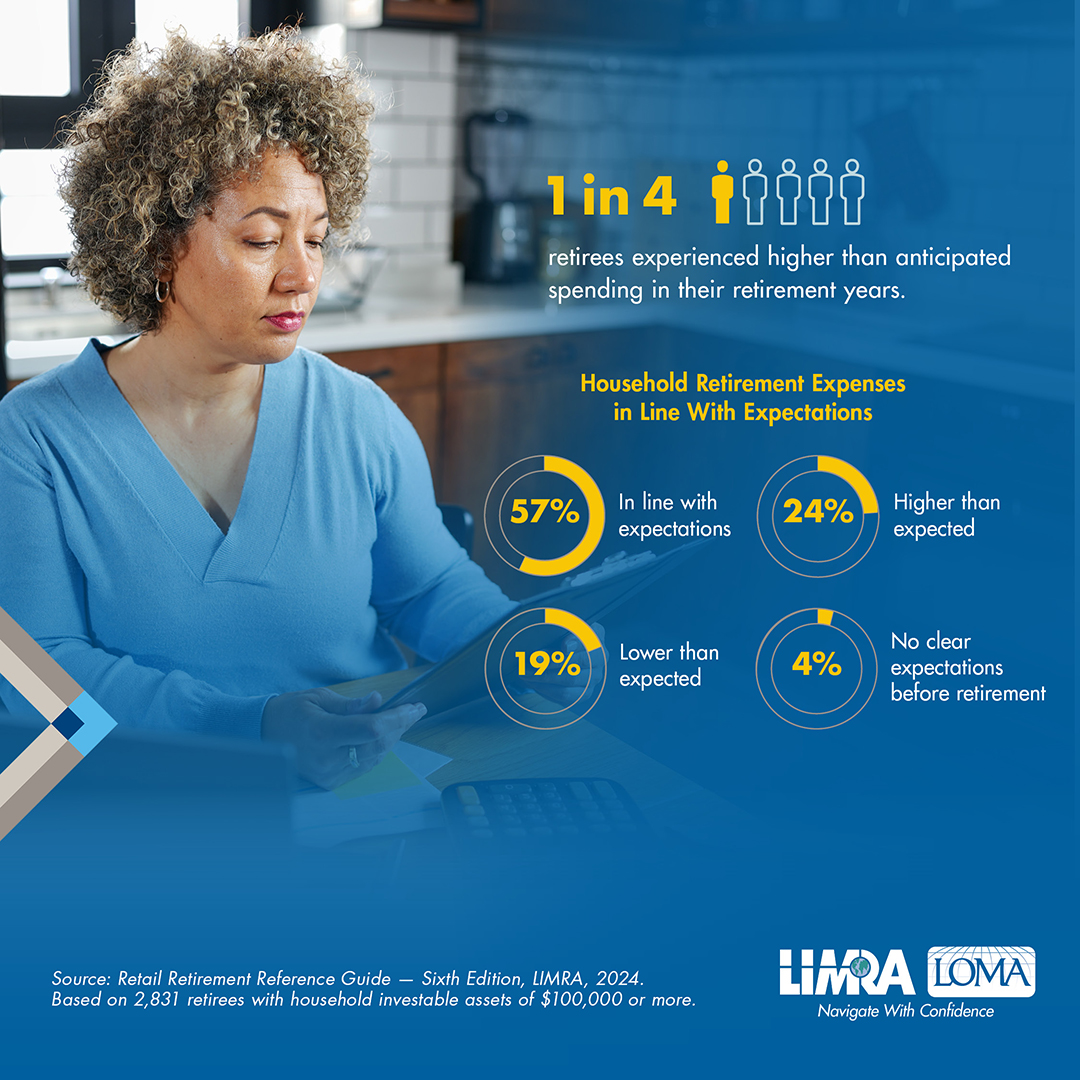

Retirement presents new and unique risks that retirees and pre-retirees must be prepared for. Over one-third of pre-retirees have major concerns about running out of money in retirement; women are more likely than men to have this concern (38% versus 28%). Rising healthcare costs along with looming talks of cutting Medicare could add substantial expenses for future retirees. Seventy-three percent of married couples must also prepare for one spouse outliving the other by at least 5 years.

Financial professionals can help provide peace of mind by helping clients create a formal written plan tailored to their individual goals and needs. Doing so helps build trust and loyalty among their clients while empowering their clients with greater confidence toward their retirement security.

- end -

Get social with us this National Retirement Security Month

Educate and engage your consumers this month with our social media factoids. Download below:

|

|

|

To download the animated content, click the share icon on the bottom right and then select "download":

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184