Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

LIMRA.com and LOMA.org will be off-line for scheduled maintenance February 21, 2026 from 6 - 10 a.m. ET.

7/11/2024

New study by LIMRA and Life Happens suggest other financial priorities undermine life insurance ownership

A new study finds 57% of Canadian adults say they have life insurance coverage. This represents a three-point increase from a similar study conducted by LIMRA in 2019.

Despite the increase in ownership, nearly a third of Canadians say they are living with a life insurance coverage gap. According to the 2023 Canadian Insurance Barometer Study, conducted by LIMRA and Life Happens, 31% of Canadians – 8.4 million adults - say they need or need more life insurance coverage.

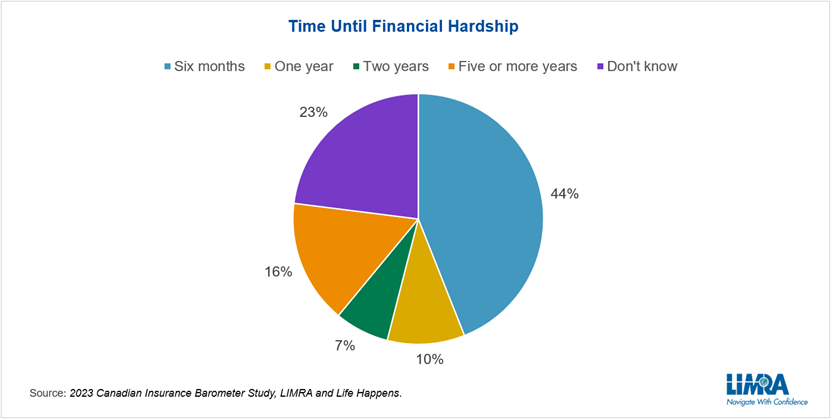

This coverage gap makes it less likely for Canadians to feel confident they could withstand a financial shock. 4 in 10 Canadians say their families would face financial hardship withing six months should the primary wage earner die unexpectedly. Another quarter said they didn’t know how long their families would be financially stable.

Financial Worries Present a Barrier to Purchase

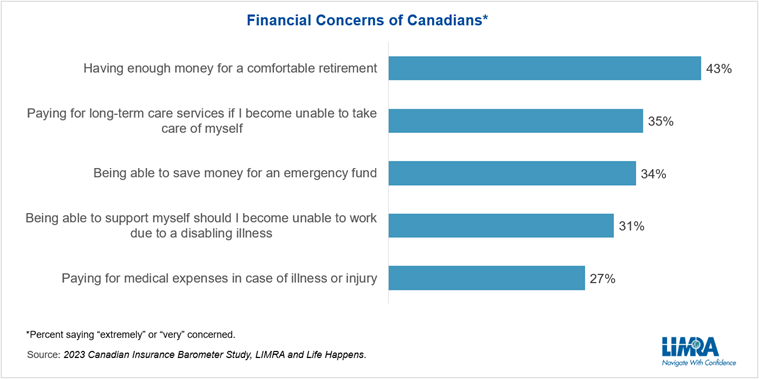

Like the U.S., Canadians express the greatest financial concern about saving enough for a comfortable retirement. More than 4 in 10 Canadians (43%) say they are very or extremely worried about this. Half of Canadians say their loved ones would turn to retirement savings to pay bills should the primary wage earner die unexpectedly. For many of these individuals, having adequate life insurance could protect their future financial security in retirement.

But Canadians’ financial concerns reach beyond retirement savings. Paying for long-term care (35%), saving for an emergency fund (34%), supporting oneself if disabled or too sick to work (31%) and paying for emergency medical expenses (27%) also rank as the top five concerns.

Yet, financial concerns play a key role in why so many Canadians are uninsured or underinsured. More than half of Canadians (53%) say they haven’t purchased the coverage they know they need because they believe it is too expensive and a third say it is because they have other financial priorities.

Fortunately, the research suggests that Canadians do see the value of life insurance — about half of respondents say they would turn to life insurance and/or savings accounts for financial support. This presents an opportunity for financial professionals and carriers to emphasize the importance of life insurance ownership.

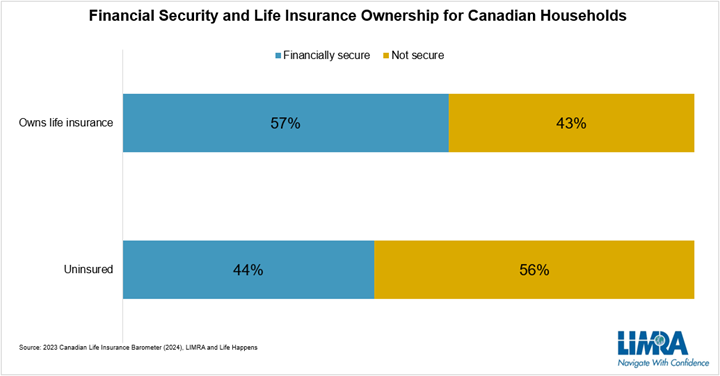

One way is to show how owning life insurance can provide financial peace of mind. Nearly a quarter of Canadians worry about leaving their dependents in a difficult financial situation should they die prematurely. Yet, 57% of Canadians who own life insurance say they feel financially secure compared with 44% of non-owners. Emphasizing that life insurance can provide a safety net for loved ones may help alleviate concerns about leaving loved ones unprotected.

The study shows there is still work to be done to educate and empower Canadian consumers. Just 1 in 5 Canadian adults feel very knowledgeable about life insurance, and over a third overestimate the cost of life insurance by three times the true amount. To combat this lack of knowledge and misperceptions, carriers and financial professionals should increase efforts using digital platforms and tools to educate consumers about how affordable and accessible life insurance is and demonstrating the valuable role it plays in safeguarding loved ones from financial harm.

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834