Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

7/2/2024

LIMRA research reveals benefits are critical to both employees and employers

Coming out of the pandemic, the way we work has changed significantly. Today, there are five generations in the workplace, more employees are working remotely or in hybrid roles, and others are working as gig or freelance workers. As a result, employers are facing substantial competition for top talent.

These changes have influenced the workplace benefits industry. According to LIMRA research, 70% of employers say their company’s benefits package will be critical to attracting and retaining the best workers. In addition, 51% believe their company will be offering more benefits in the future than it does today and 61% of employers say their employees will expect a wider variety of benefit options.

The study shows there is growing interest in gig work. LIMRA research shows that of the 66% of employees who currently work at a traditional job, 36% say they are likely to pursue a freelance or gig position within the next five years. Similarly, for those who supplement their traditional job with freelance work, 65% say they will look to make their freelance work their primary source of income.

At the same time, more employers are looking to leverage freelance workers, and many employers are looking to provide benefits to these workers. For carriers and other benefits providers, this will have an impact on things like product design and who is eligible for benefits.

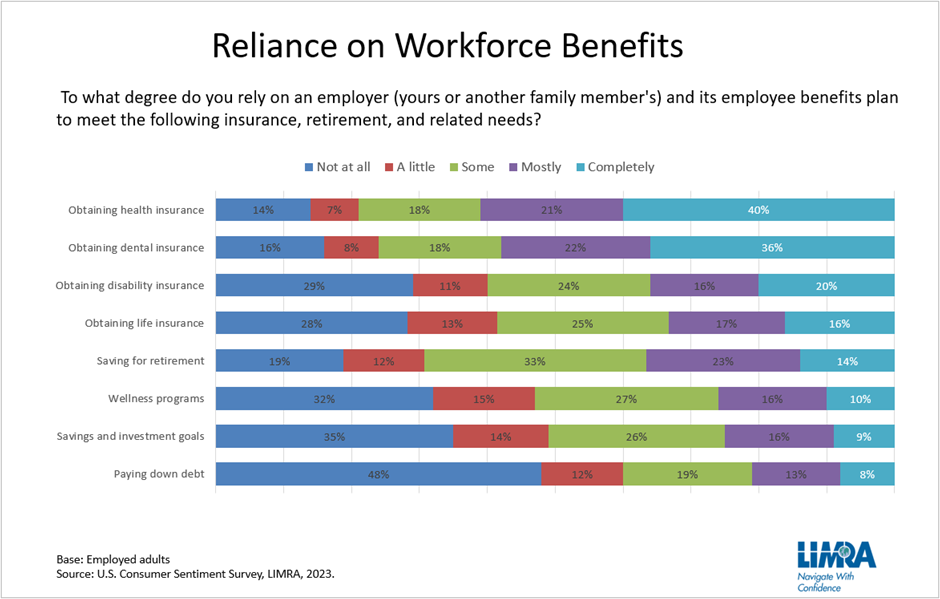

Today, many employees — especially middle-income workers, younger workers, and those who currently don’t work with a financial advisor — rely heavily on an employer to provide a comprehensive benefits package.

LIMRA research shows employers want to offer traditional and non-traditional benefits that can help workers address the financial risks they face. Yet rising medical premiums are putting a squeeze on employers’ ability to provide a broader employer-paid benefits package. As a result, more companies are offering benefits on a contributory or voluntary basis, shifting the costs to their workers.

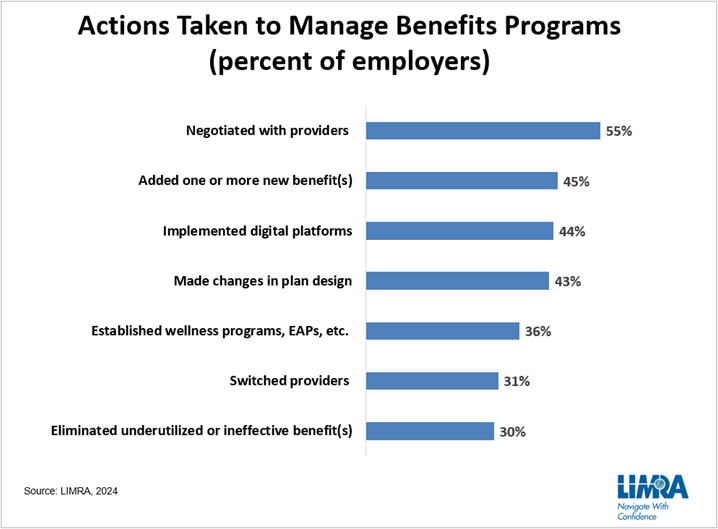

In a recent study, LIMRA asked employers what steps their company has taken in the past two years to manage their benefits program. Over half (55%) of employers said their company negotiated with providers for better terms, lower premiums, fees, etc., to better manage costs. Yet almost half (45%) said they added one or more benefits to remain competitive.

Employee Education and Communication Is Critical

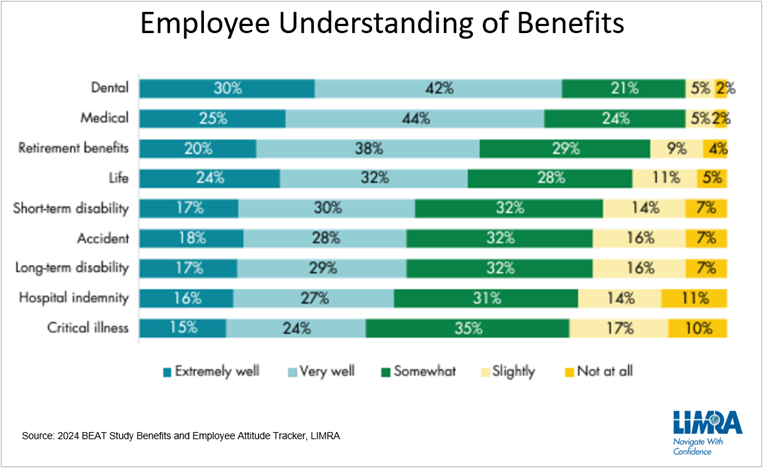

Another issue around workplace benefits is the need for stronger benefits education and tools that help employees make decisions about the coverage they need. Other LIMRA research shows that workers really don’t have a good understanding of what benefits are available to them, and the details about those benefits.

The most understood benefits are dental, medical and retirement. More than 7 in 10 employees (72%) understand dental benefits extremely or very well, while almost the same amount (69%) say that about medical insurance. When it comes to benefits like retirement, life insurance and short-term disability, the level of understanding is much lower, 58%, 56% and 47% respectively.

As far as communication goes, LIMRA research shows half of employees (50%) currently only receive communication about benefits once a year during open enrollment. According to the research, almost 1 in 4 employees (24%) would like to have communication around benefits frequently throughout the year.

For insurers and other benefits providers, the priority must be to develop more flexible offerings that can be modified to meet changing needs at different life stages and deliver them in an engaging way that resonates with the workers of the future.

To learn more about workplace benefits, watch June’s episode of Industry Insights With Bryan Hodgens — The Changing World of Workplace Benefits.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257