Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

8/6/2024

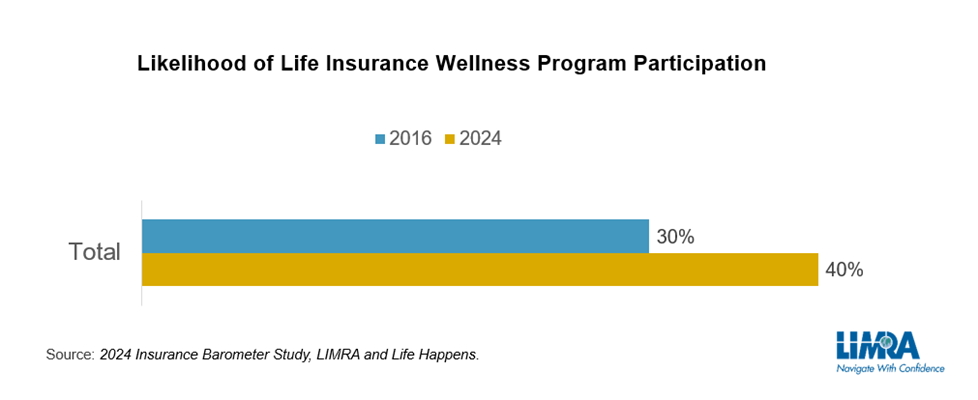

According to the 2024 Insurance Barometer Study, more Americans say they would participate in a life insurance wellness program than in previous years. These programs involve consumers exchanging health or activity data for incentives like discounts on premiums or products. The percentage of willing Americans increased 10 points over the past 8 years, from 30% in 2016 to 40% in 2024.

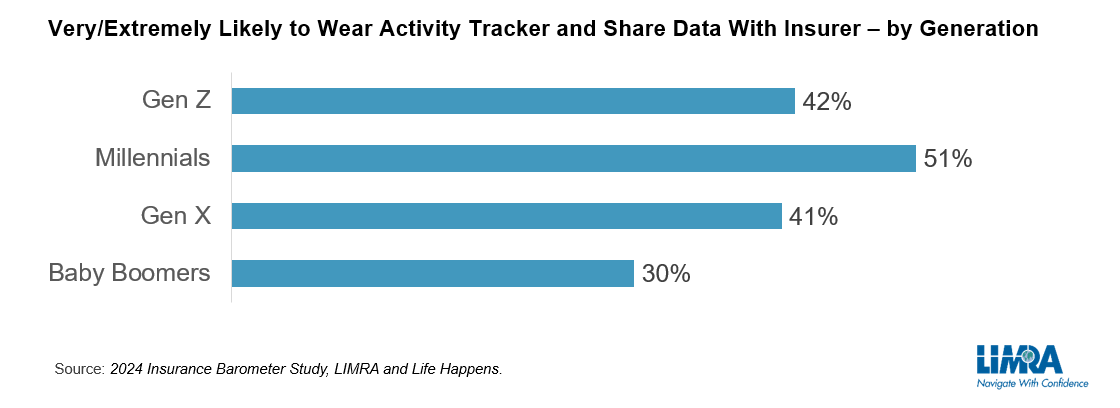

Interest in life insurance wellness programs increased across all demographics. Younger adults, in particular, have more interest than older generations. Over half of Millennials and 42% of Gen Z adults say they would be willing to wear an activity tracker and share data with a life insurer compared to 41% of Gen X and 30% of Baby Boomers.

Almost one third of Americans are wearing some type of fitness tracker, according to the National Heart, Lung, and Blood Institute. As wearable technology, smart phones, and apps become more ingrained in our everyday life, this presents an opportunity for the life insurance industry to continue exploring wellness incentive programs for consumers.

The Barometer Study identified two different types of incentive programs that consumers would be interested in. Both involve ways of reporting consumer data back to their insurer.

“Active Sharing” Programs

The first type of incentive program is known as “Active Sharing.” As the name suggests, active sharing programs require the participant to report activities and behaviors to their insurance company. Examples include gym visits, vaccinations, physical exams, and test results.

Sixty-six percent of consumers who are interested in this type of wellness program cite savings and discounts as the top reason. Conversely, 46% of consumers with little to no interest mentioned privacy concerns as the main reason. Millennials had the most interest in this program (50%) compared to 39% of Gen X and Gen Z adults and just 30% of Baby Boomers.

Millennials are more likely to feel confident about their health and gym attendance. They are also more comfortable with data sharing and rewards programs, having grown up with the advent of smartphones, apps, and social media. Therefore, Millennials may not feel the same sense of intrusion as older adults. We expect Gen Z to share similar feelings as they mature.

“Passive Sharing” Programs

In a “Passive Sharing” incentive program, reporting involves passively sharing data on activity completed per day. Examples include heart rate, calories burned, hours slept, miles walked, etc. The idea is that an activity tracker worn on the wrist or chest would track a participant’s daily movement and share that data with the insurer.

Nearly 7 in 10 consumers (65%) say participating in this kind of program would help them establish activity goals and make healthier choices. Similarly to “Active Sharing” programs, 46% of uninterested consumers believe they would be sharing too much information.

Protecting Personal Data Is a Priority

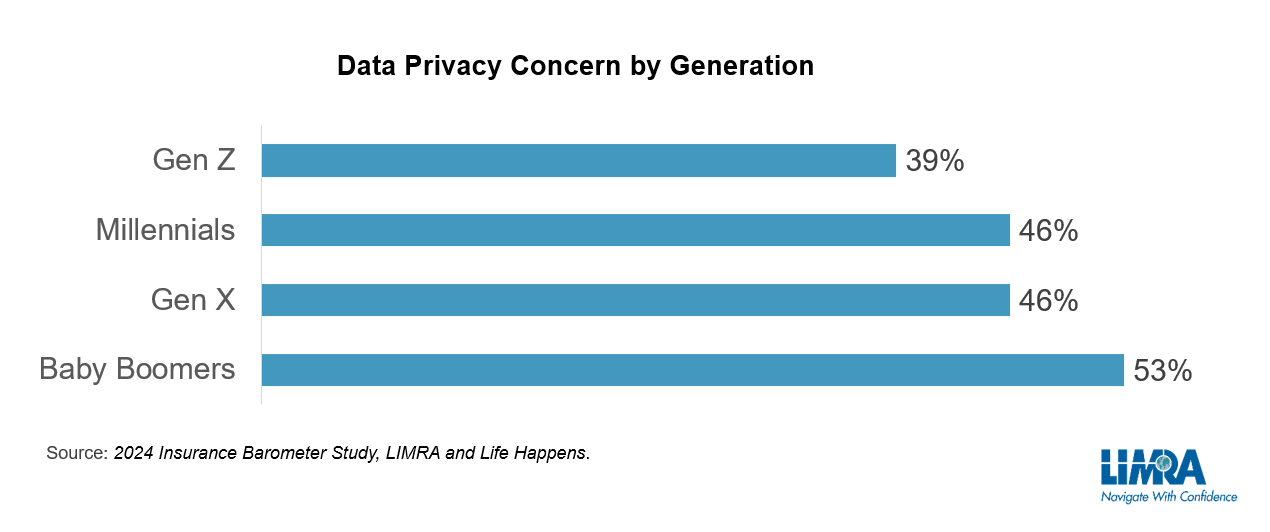

Historically, convincing consumers to share personal health information and daily activities has had mixed results. Even though smartphones and wearables are an increasing part of our lives, consumers still have concerns about how their data will be used — especially older Americans.

More than half (53%) of Baby Boomers are very concerned about data privacy. Forty-six percent of Gen X and Millennial adults share similar levels of concern, followed by nearly 4 in 10 (39%) Gen Z consumers. This should be a strong reminder to the insurance industry to keep trust at the forefront of their business practices.

Over 100 million American adults say they need (or need more) life insurance. A consistent theme over the past several years is the need for more education and awareness in our industry. An incentives-based wellness program could be a solid way to reinforce the importance of owning life insurance while also rewarding positive and healthy behaviors. Life insurers who can balance offering rewards for access to consumer health data while giving those consumers the confidence that their data is protected could realize successful business outcomes.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257