Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

1/9/2025

In recent years, favorable economic conditions and demographic shifts have driven demand for investment protection and guaranteed lifetime income solutions that are unique to annuity products.

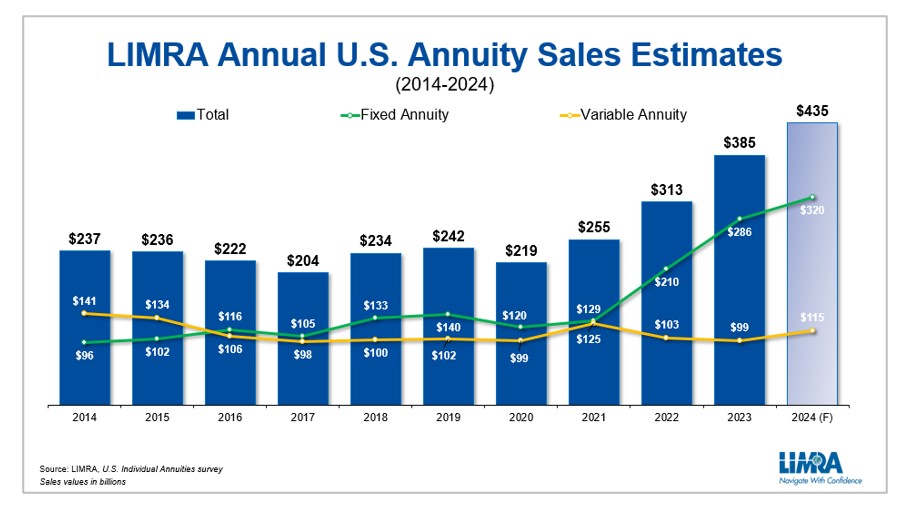

Collectively, annuity sales will exceed $1.1 trillion from 2022-2024.

“The past few years have been remarkable for the U.S. annuity market. For 2024, we're conservatively expecting annuity sales to be over $430 billion,” said Bryan Hodgens, senior vice president and head of LIMRA Research. “The growth was largely driven by fixed-rate deferred (FRD) annuity sales, but fixed indexed annuities (FIAs) and registered indexed-linked (RILA) annuities will also set records in 2024.”

Key Economic Factors Influencing Market Trends in 2025

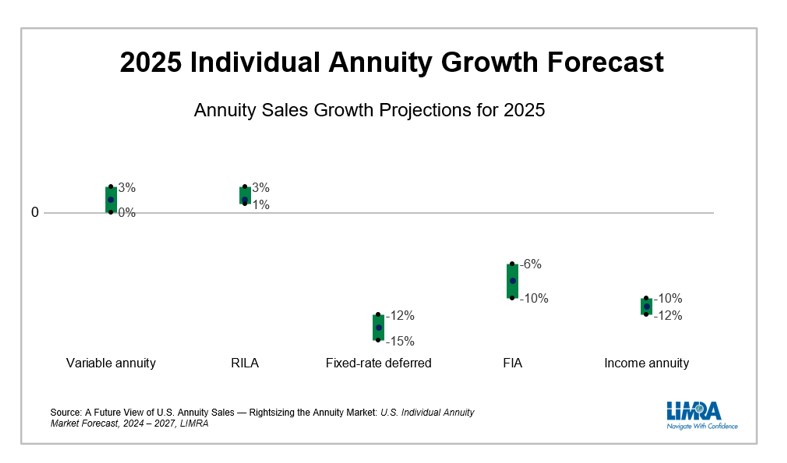

With equity markets expected to remain strong in 2025, LIMRA projects traditional variable annuities (VA) and RILA sales to grow in 2025. Interest rates are projected to continue to fall in 2025. Lower interest rates will negatively impact sales growth of FRD annuities, income annuities and, to a lesser degree, FIAs.

Inflation will remain an economic factor to watch through 2027. Consumers will look to annuity-type investments to keep pace with inflation. But aging demographics will prop up demand for annuities. The U.S. population ages 65 and over is expected to grow by more than 7.5 million from 2023-2027. LIMRA’s research shows annuity buyers tend to be around 65, so this growth will create a larger target market for income solutions.

Fixed-rate deferred annuities

FRD products have driven the overall market growth, representing over 40% of sales in 2023. Falling interest rates will dampen the demand for FRDs but with a significant amount in FRD contracts coming out of surrender over the next couple of years. LIMRA expects a large portion of those assets to be reinvested in FRD products. With expected FRD sales to be around $160 billion in 2024, LIMRA is projecting FRD sales to drop between 15% - 25% ($122 – $147 billion) as interest rates fall in 2025.

Fixed indexed annuities

FIA sales will set a new record in 2024, marking the third consecutive year of new sales records. FIA sales are on track to surpass $120 billion in 2024. To put this into perspective, that’s nearly double the sales in 2021. In 2025, LIMRA is projecting FIA sales to drop 5%-10% from the record set in 2024 but remain above $100 billion.

Registered index-linked annuities

RILA sales will mark its 11th consecutive year of record-high sales in 2024. Investors interested in protected growth coupled with continued strong equity markets has made this product in demand. LIMRA projects 2025 RILA sales will remain at or slightly above the record levels set in 2024 and to be around $62 billion and $66 billion in 2025.

“RILA’s success is due to continued investor uncertainty about the economy. Across the board, we see investors seeking products that offer a combination of downside protection and upside growth potential,” said John Carroll, senior vice president, head of Life and Annuities, LIMRA and LOMA. “Momentum is growing for this product line. At least seven carriers entered the market in 2024, while existing RILA carriers continue to innovate their products offering attractive index caps and participation rates. LIMRA expects RILA sales to continue to grow in 2025.”

Traditional variable annuities

After posting the lowest sales on record in 2023, traditional VA sales rebounded in 2024. Double-digit growth in the equity market, product innovation and increased interest from registered investment advisors will propel VAs to reach nearly $60 billion in 2024.

VA sales should stay in this range for the foreseeable future, assuming market conditions remain stable. LIMRA is projecting 2025 VA sales to be level with 2024 results.

Income annuities

After record-high sales in 2023, income annuities — propelled by compelling demographics trends and attractive payout rates — should exceed $18 billion in 2024, setting another record. In 2025, lower interest rates will compel carriers to drop their payout rates, resulting in a 10% cut for income annuity sales. LIMRA is projecting income annuity sales to be between $16 billion and $18 billion in 2025.

Big picture – Total Annuity Sales Forecast

It will be a mixed outlook in 2025 for the overall annuity market. While market conditions and demographics are very favorable for the annuity market, a decline in interest rates (which propelled the remarkable growth in 2023 and 2024) will undercut fixed annuity products continued growth. For 2024, we expect sales to be more than $430 billion, up between 10% to 15% over 2023.

“LIMRA is forecasting 2025 annuity sales to fall back to 2023 levels in the $364-$410 billion range,” Hodgens noted. “This is still more than 50% higher than pre-pandemic sales and suggests that the market has expanded as investors realize the intrinsic value of protection-based solutions to secure their retirement security.”

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257