Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

1/15/2025

Slower growth forecasted in the workplace life and disability markets as employment and wages tighten.

LIMRA forecasts for the workplace life insurance and disability markets suggest tempered expectations in 2025. As 2024 showed a resilient economy, LIMRA expects growth to continue, albeit more slowly. Overall, workplace life and disability growth rates are expected to return to their historical trends prior to the 2020 pandemic. However, carrier innovation for products, services, and marketing will be key to achieving above-average growth.

Workplace life and disability growth is driven by employment, wages and salaries, and overall economic activity. Workplace life in 2025 is expected to grow 3%, just shy of its historical average of 3.1% before COVID. Both long-term and short-term disability benefits are projected to land above their historical averages this year with long-term disability reaching 3.8% in 2025 (compared to its historical average of 2.7%) and short-term disability achieving 4.0% (slightly above its historical average of 3.8%).

“We are cautiously optimistic about workplace benefits in 2025,” said Anita Potter, assistant vice president, workplace benefits, LIMRA. “The labor market is still tight with low unemployment, and employers are focusing on employee retention strategies. Forty-five percent of employers said they added one or more benefits within the past two years.”

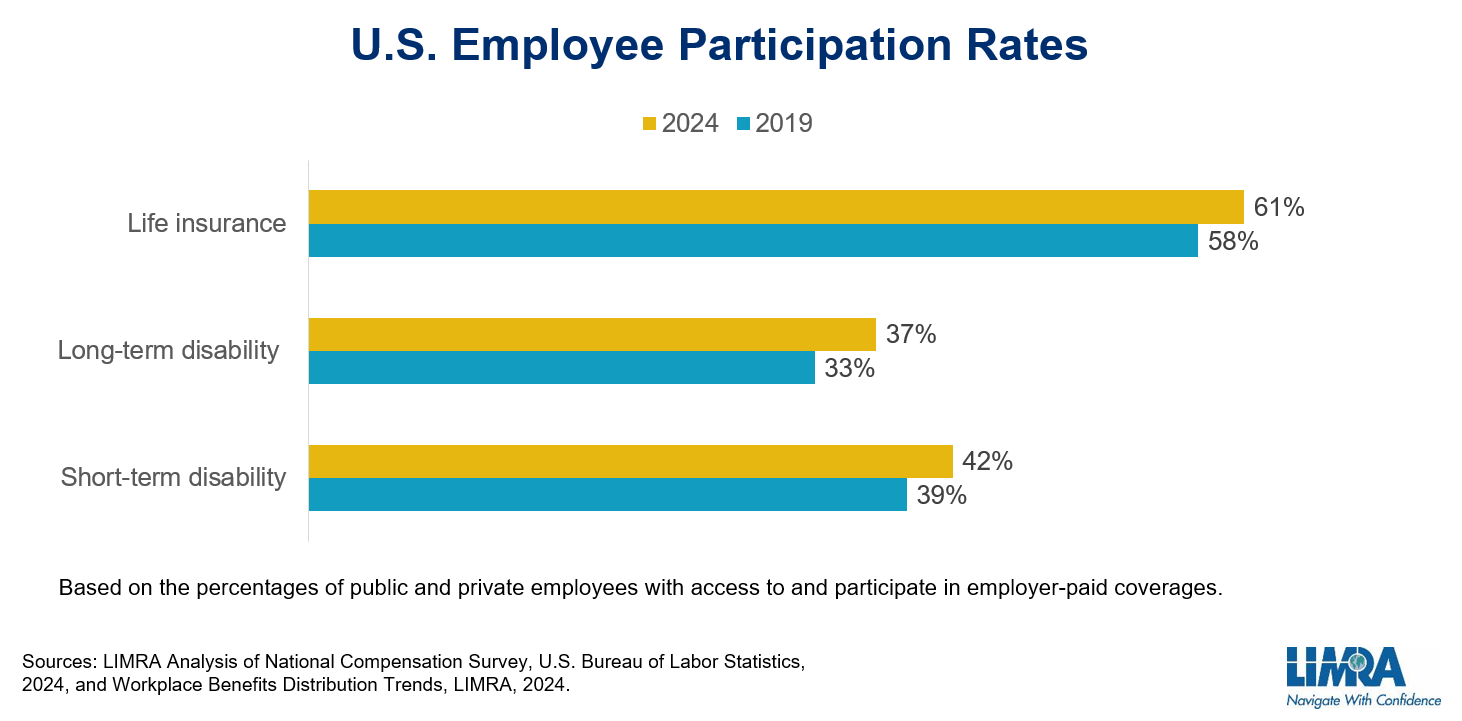

LIMRA research finds 7 in 10 employers believe that their benefit strategies have a considerable influence on their ability to attract and retain talent. LIMRA data also show participation rates in workplace life and disability benefits have increased from pre-pandemic levels, suggesting that more workers are -covered by their employer-sponsored programs.

Yet, research suggests carriers should remain vigilant about the headwinds they face in the years to come. The economic climate, rising healthcare costs and receding wallet share all could impact carriers and their success in the workplace market.

First, both employment and wage growth are expected to slow down as the demand for goods and services decreases. Likewise, unemployment will gradually increase. The national debt is also expected to place pressure on interest rates. The U.S. Congressional Budget Office predicts that public debt will reach 116% of GDP by 2034.

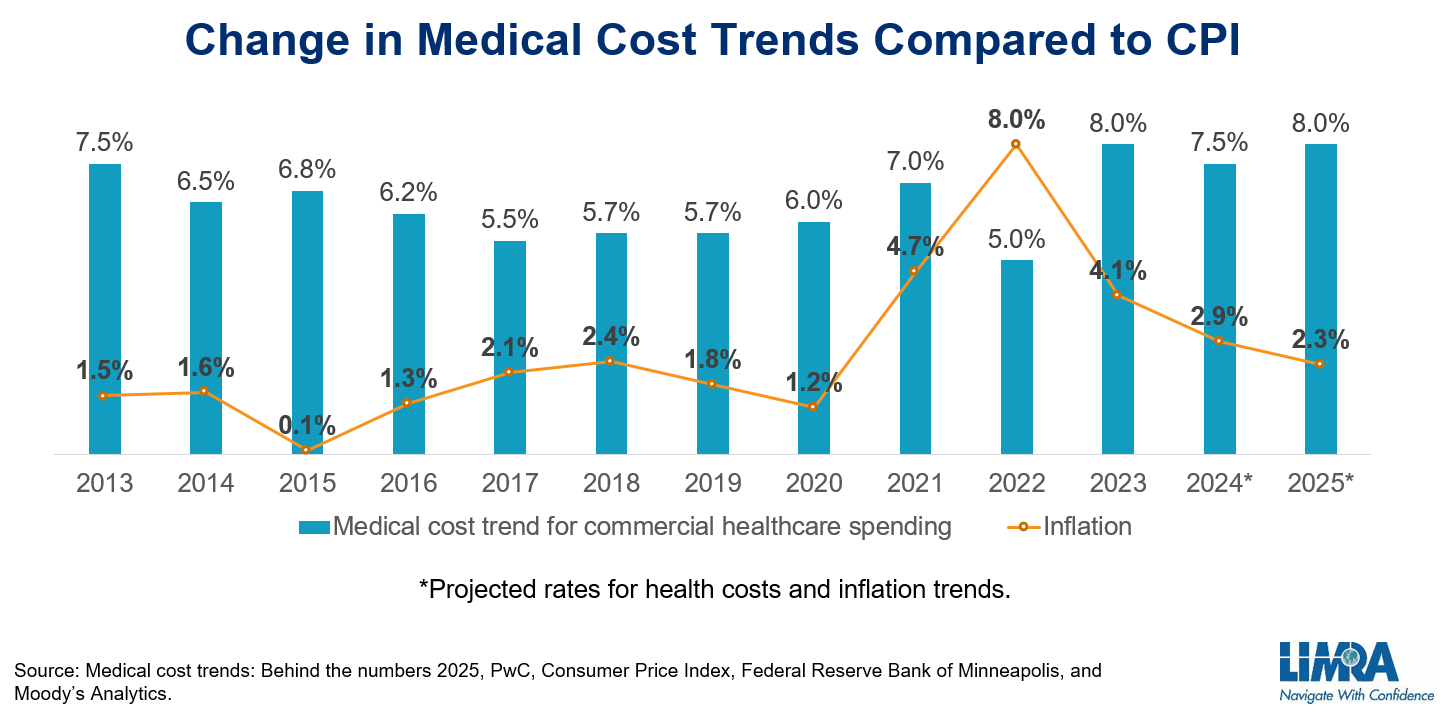

Next, health care costs are outpacing inflation levels. According to PWC, health care spending in 2025 could increase by 8% — the highest level since 2012, excluding any plan changes. Mercer reports that, in 2025 alone, health care costs are expected to rise by 5%.

Economic conditions combined with rising health care costs places pressure on employers who must evaluate their cost of benefits. LIMRA data shows that 4 in 10 employers say that the cost of benefits has the highest influence on their benefits strategy.

Employers are not the only ones feeling the crunch — employees are tightening their wallets in response to higher costs. Wage increases have not kept up with inflation. Since 2001, prices have increased 20% while wages increased 17.4%, according to Bankrate’s wage-to-inflation index. LIMRA research finds employees decreased the median monthly amount they are willing to spend on benefits from $150 in 2023 to $120 in 2024.

As employers and employees respond to the economy and rising healthcare costs, carriers can continue to demonstrate their value through innovating their non-medical products, services, and marketing strategies.

Without innovation, growth in these markets is contingent upon how well the economy performs. LIMRA is forecasting continued growth in the workplace life insurance and disability markets after 2025, but at a slower pace.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257