Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

2/13/2025

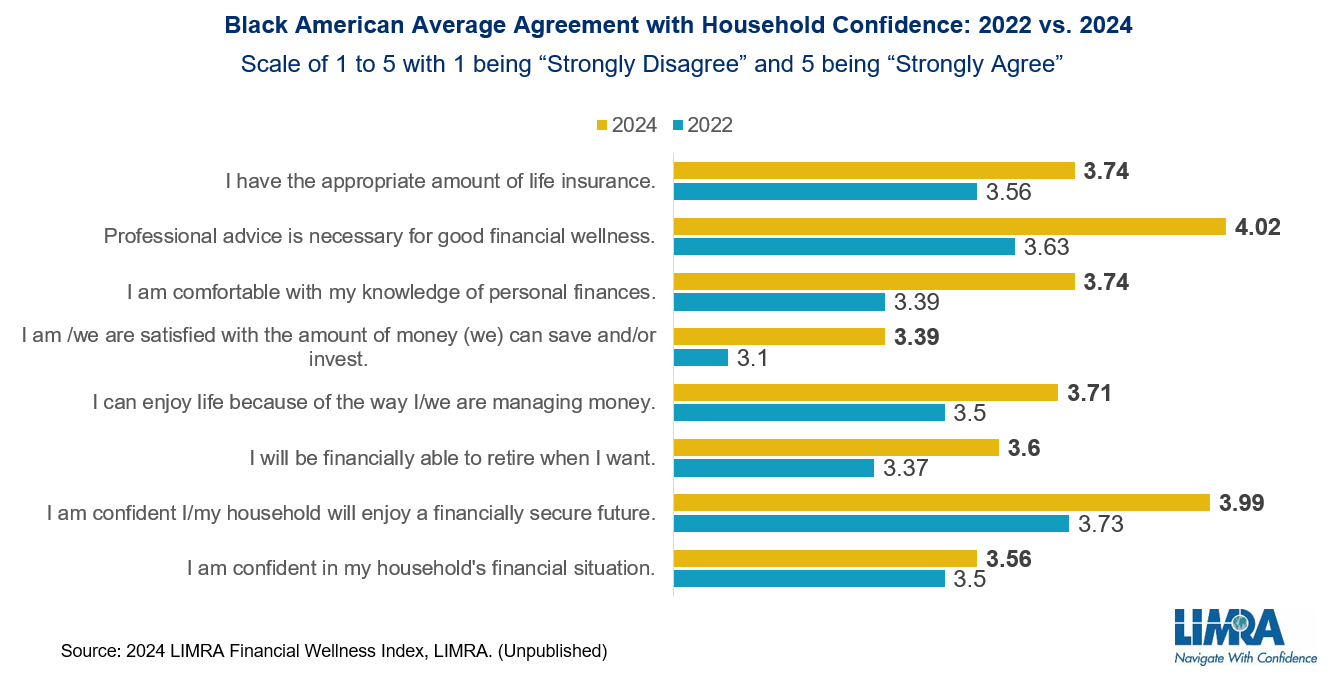

LIMRA data from the 2024 Financial Wellness Index (conducted early 2024) reveals that Black American workers are more confident in their household financial situations than in 2022. When asked to rate their level of agreement in 2024, Black Americans indicated higher agreement on their household financial confidence.

Notably, Black American workers showed higher agreement in 2024 than in the prior study that professional advice was necessary for financial wellness, knowledge of personal finances, and confidence that their households will enjoy a financially secure future.

Beyond the workplace, more Black Americans (61%) believe their personal financial situation will improve in 2025 compared with the general population (51%), according to LIMRA’s January 2025 consumer sentiment study. This suggests that despite facing financial challenges, Black Americans express interest in financial solutions, life insurance, available to them from both inside and outside the workplace.

The research shows that over three-quarters of Black American workers (77%) say their employers should offer services to help address or reduce employee financial stress — an eight-point increase from 2022 (69%). About three-quarters of Black American workers (74%) viewed their workplace benefits as integral to their financial wellness. This suggests Black Americans find their workplace benefits valuable to meeting their financial needs.

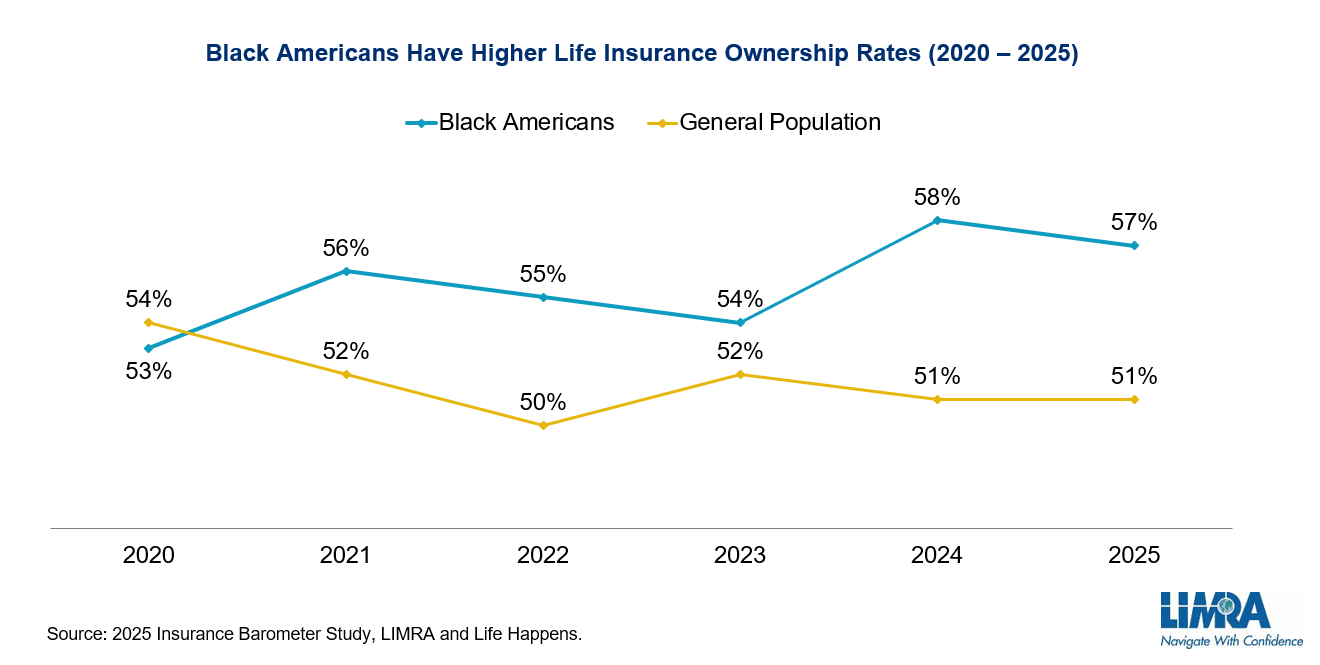

According to the Insurance Barometer Study from LIMRA and Life Happens, Black Americans have had elevated concerns about saving for retirement, being able to support themselves if they can no longer work, or building an emergency savings fund. Since the COVID-19 pandemic, however, Black Americans have reported consistently owning life insurance at higher rates than the general population.

The study also found that Black Americans were slightly less likely than the general population to cite expense or other financial priorities as reasons for not owning life insurance, suggesting they may have a slightly different view of where life insurance fits into their financial well-being.

Despite lower financial optimism in 2025, Black Americans clearly express a strong willingness to seek resources to improve their financial situation. Both employers and the financial services industry can help make this a reality.

Employers can provide more educational benefits that promote overall wellness. These programs can help all workers to manage their financial, emotional, and physical stressors. Nearly 8 in 10 employees say they need education on managing their financial future.

Financial professionals can also play a role by looking for more effective ways to engage the Black American market. An active social media presence, for example, can connect Black Americans with educational tools or resources. Fifty-two percent of Black Americans turn to YouTube to find helpful financial product-related information, and over half of Black Americans (44%) consider the reviews and comments of others when evaluating a financial advisor.

In recognition of Black History Month, our industry has an opportunity to help more Black Americans achieve greater financial security. Despite continued financial obstacles, the research shows Black Americans want to improve their personal financial situations.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257