Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

4/1/2025

A majority of American workers and their families rely on workplace benefits for their insurance needs. In a tight job market, employers use their benefits package to demonstrate their value proposition to attract new talent and keep current employees. LIMRA research finds over 60% of workers say they are at least somewhat more inclined to stay with their employer because of their benefits package. Workplace benefits are among the top three considerations when job seekers evaluate potential employers.

With five generations in the workplace, there has been a need to expand benefits beyond the basics. Employers recognize they must address new needs, particularly around things like caregiving benefits, absence and leave benefits, and wellness benefits in all forms, as well as personalizing/customizing benefits to keep their workers happy. Most employers (79%) turn to their brokers or benefits advisors to help them identify and evaluate the myriad of choices and select the benefits that best suit their employee base.

Brokers Link Insurance Carriers with Employers

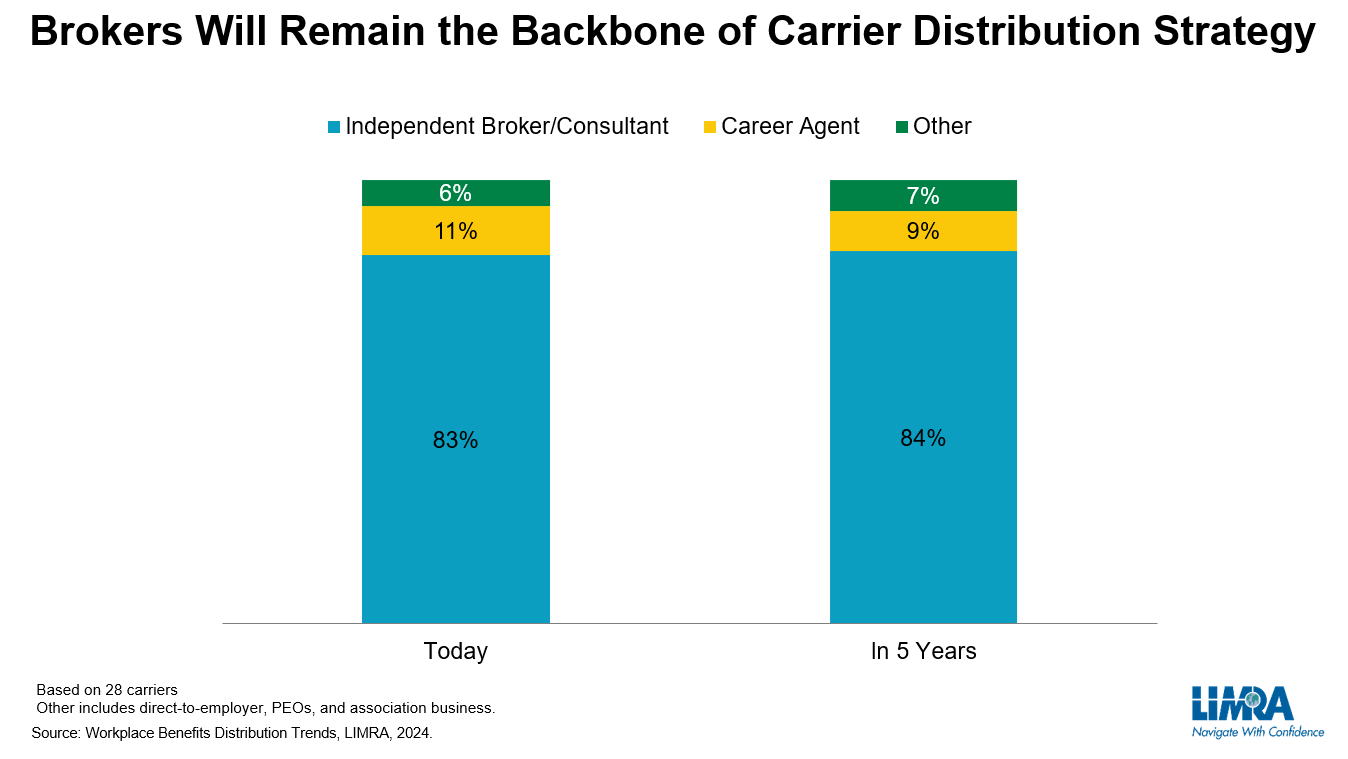

“Independent employee benefits brokers generate the lion’s share of workplace business, connecting insurance carriers and their offerings with employers, said Bryan Hodgens, senior vice president and head of LIMRA Research. Our new study, The Future Is Now — Workplace Benefits Distribution Amid a Changing Landscape, finds that brokers will continue to be the primary distribution channel for workplace benefits over the next five years.”

The study reveals that the role of a broker is evolving as employers’ needs change and benefits administration becomes more complicated. In addition to the traditional role brokers typically play in helping employers select benefits offerings and the carrier best-suited to provide them, they now also help employers manage benefits costs, navigate changing regulations, and identify the digital capabilities that will best serve their companies. Brokers have moved beyond spreadsheeting to become trusted benefit consultants.

Given the evolving landscape, it’s not surprising that nearly 6 in 10 employers expect to have a greater reliance on brokers in five years’ time.

The Impact of Technology Is Multi-Faceted

Just as technology has touched all facets of our individual lives, technology also is impacting every aspect of the workplace benefits market. Employers and workers alike value the convenience and cost savings associated with digital enrollment and claims processing, LIMRA research finds the vast majority of employees say they value personalized, digital experiences as they shop for, select, and use their benefits. Our research found 6 in 10 employees regard online enrollment and claims submission as the most valued digital services.

Similarly, employers expect to increasingly rely on benefits technology solutions to create efficiencies and enable employers’ benefits strategies, Employers say they are looking for digital enablement of the end-to-end value chain – these tools can come from three sources:

“The value and ease offered by benefits technology is becoming table stakes for employers. Carriers need to ensure their technology solutions can easily be integrated into an employers’ platforms, said Ron Neyer, associate research director, LIMRA Workplace Benefits Research. “A recent study found 4 in 10 employers would change carriers if their current insurance carrier was unable to connect their products to its benefit technology platform.”

Although technology offers many advantages, it also adds a layer of costs that are generally absorbed by carriers. Three quarters of carriers surveyed said the influence of technology firms in the ecosystem has a significant impact on their distribution strategies. Six in 10 carriers cite cost-stacking concerns as an increasing number of parties in the ecosystem are vying for a slice of compensation.

Employers will continue to demand greater economic value, asking more questions about the efficacy of their benefits program overall and benefit offerings specifically. Employers are now seeking more data-driven insights, justification for recommended approaches, and demanding economic value from their programs. This increased focus on economic value has changed the conversations that brokers are having with their clients, and as a result, change what brokers value from carriers and other partners.

While brokers will continue to drive workplace distribution for the foreseeable future, their expectations are evolving so connecting with brokers will require carriers to offer enhanced delivery models with a service-first mindset, powered by technology.

To learn more about the findings and their implications, visit: Industry Insights With Bryan Hodgens: What’s in Store for Workplace Benefits Distribution?

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257