Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

1/8/2025

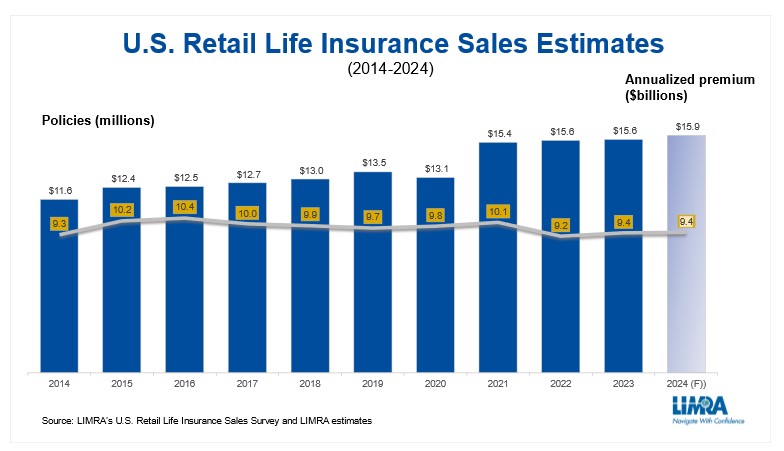

Over the past decade, life insurance premium grew slowly on average about 3% annually. While interest rates, equity markets and other economic factors impact the mix of business between individual life products, there had been no breakthrough that reached a broader audience of consumers.

The COVID-19 pandemic changed the status quo. COVID-19 elevated consumer awareness about the importance of having life insurance coverage. In 2021, we saw record-high life insurance sales and policy count growth rates not seen in more than 40 years.

Following the pandemic, life insurance premium remained elevated, setting records in 2022 and 2023. LIMRA is forecasting life insurance premium to reach $15.9 billion in 2024 — a new record — and continue to grow in 2025.

Key Economic Factors Influencing Market Trends in 2025

Equity markets are expected to increase in 2025, although some projections anticipate a downturn later in the year. LIMRA predicts this will benefit all products but particularly variable universal life, which has experienced remarkable growth in 2024. While interest rates are projected to continue to fall over the next year, it may not be as substantial as expected. Lower interest rates could relieve pressure on indexed universal life (IUL) and whole life (WL) sales. Inflation and unemployment are down, which are typically good for products, particularly term and whole life. Incomes are expected to increase at or slightly faster than inflation.

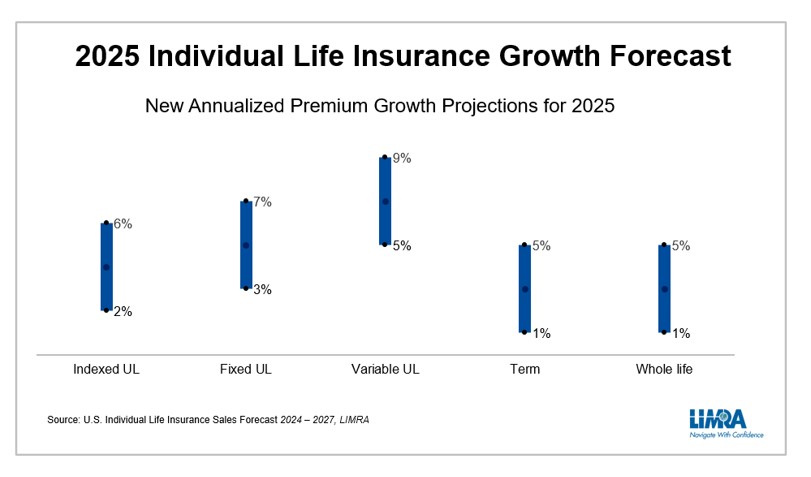

Whole life

Interest rates have had a negative impact on recent WL sales. Rising interest rates have shifted WL sales towards products with longer premium payment periods, which have a lower annual premium. WL sales are projected to decline through the end of 2024. As the yield curve is expected to revert to normal, LIMRA expects WL sales to return to positive growth — between 1% and 5% — in 2025.

Term life

After falling 5% in 2022, term sales quickly rebounded in 2023, although gains strongly reflect the experience of the top carriers. Digital platform expansions and more competitive pricing drove much of the growth. LIMRA is forecasting premium growth to be level through the rest of 2024, and low to moderate growth (between 1% and 5%) to resume in 2025.

“Whole life and term are often considered the core of the life insurance business. These products have represented more than 85% of the policies sold and a majority of the new premium collected each year,” said John Carroll, senior vice president and head of Life and Annuities, LIMRA and LOMA. “While recent higher interest rates have had a negative impact on whole life sales and inflation has likely dampened the term sales a bit, LIMRA expects both product lines to grow in 2025.”

Variable Universal Life

Strong stock market growth has made this product more appealing in recent years. In 2024, LIMRA is predicting double-digit premium growth (up 12% to 16%). Assuming continued equity market increases, LIMRA expects VUL premium to grow moderately (rising 5% to 9%).

“The VUL market has undergone substantive changes in recent years,” noted Byran Hodgens, senior vice president and head of LIMRA Research. “In 2023, just a few carriers were driving most of the sales. In 2024, as equity markets continued to rise, we started to see more companies selling VUL products, particularly protection-focused products, with death benefit guarantees. We expect double-digit growth in 2024 and up to 9% growth in 2025.”

Indexed Universal Life

The interest rate environment significantly shifted the IUL market, splitting it into two distinct market segments: traditional indexed life carriers and distributors, which have experienced a decrease in premium sales over the past few years; and carriers and distributors focusing on simplified products with a lower face amount, which have had significant success. In 2024, LIMRA is forecasting IUL premium to increase 3% to 7%. Sales growth will continue in 2025, projected premium growth is expected between 2% and 6% in 2025.

Fixed Universal Life

After years of decline, driven by falling interest rates, fixed UL sales began to rebound in the second half of 2023, and continued into 2024. LIMRA expects fixed UL sales to remain strong through the end of 2024, up 8% to 12%. In 2025, with interest rate declines the pace of growth will be moderate (up 3% to 7%).

Big picture – Total Individual Life Sales Forecast

Market conditions are very favorable for the individual life insurance market. In 2024, we expect total premium to be level with or above the record set in 2023 (up 1% to 5%). While there may be shifts in the product mix, LIMRA is forecasting 2025 sales growth to improve — increasing between 2% and 6%.

LIMRA will publish highlights from the annuity sales forecast tomorrow. To learn more about LIMRA's 2025 life insurance and annuity forecasts, see our latest LinkedIn Live with Bryan Hodgens.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257