Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

6/26/2024

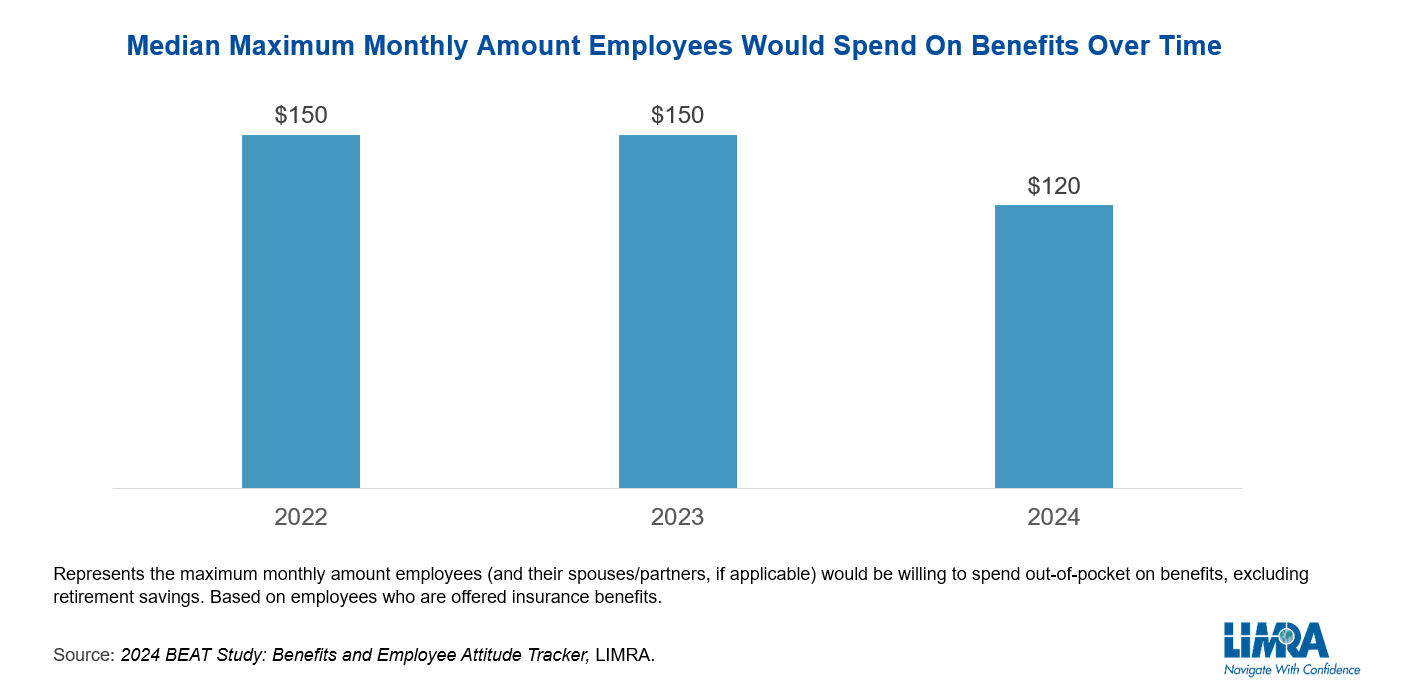

WINDSOR, Conn., June 26, 2024—New data from LIMRA’s 2024 BEAT Study: Benefits and Employee Attitude Tracker reveals that employees are willing to spend less on their benefits than in previous years as benefits costs increase. The new monthly median consumers will spend is $120 (excluding retirement savings) — down $30 from the prior two years.

“The amount employees are willing to pay has declined over the past few years, no doubt due to inflation and tighter wallet share,” explains Kimberly Landry, associate research director for workplace benefits research at LIMRA. “This might lead to employees looking to reduce or drop certain benefits to save money. If rising costs continue, employees may also look to reduce their retirement contributions.”

Factors affecting benefits budgets

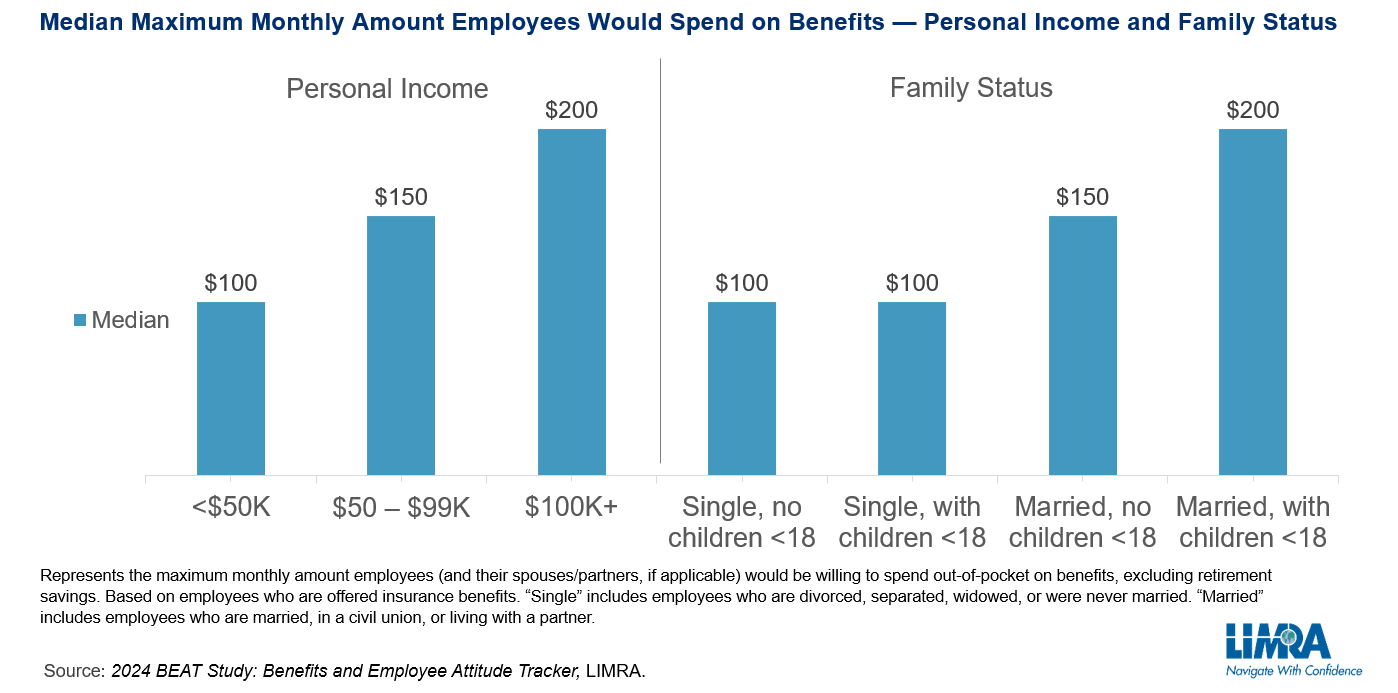

The LIMRA study shows that demographics play a role in how much workers will spend on employee benefits. According to LIMRA, employees with higher incomes, those who are married with dependent children, younger workers, and workers who are already enrolled are more likely to spend more on their workplace benefits. For example, enrolled employees are willing to spend a median of $150 per month on benefits, versus $100 for employees who are offered benefits but are not enrolled.

Understanding and communicating benefits options

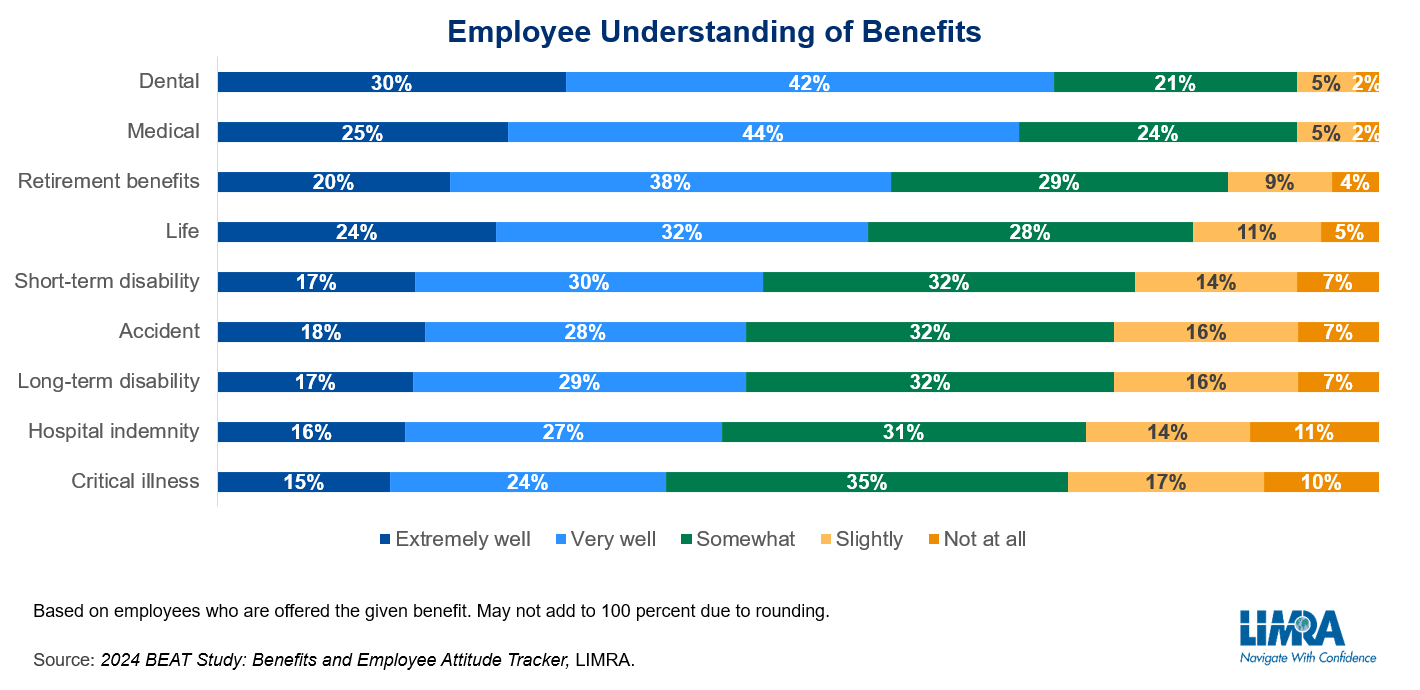

There are opportunities to improve workers’ understanding of their benefit offerings. LIMRA data shows a wide range in employees’ understanding of benefits. The study finds employees have a higher understanding of core benefits such as dental, medical insurance and retirement savings, whereas they understand disability insurance and supplemental health plans the least.

Improving education efforts around these lesser-understood benefits could improve their enrollment and usage. Employees who do not understand these benefits may mistakenly think something is covered when it’s not, or they may neglect to file eligible claims.

Communication remains crucial for keeping employees educated about their benefits. Fifty-four percent of employees feel their employer communicates details about their benefits very or extremely well, leaving significant room for improvement.

One factor is timing. LIMRA data notes that the frequency of benefit communications goes hand-in-hand with how employees perceive the quality of the communications. Nearly three-quarters of workers (73%) say they would like to receive benefits information more frequently throughout the year. Yet half of workers say their employer only communicates about their benefits during open enrollment.

Bundling benefits

Some carriers wonder if bundling benefits would help ease the enrollment decision-making process for employees. When asked, 3 in 10 employees said they would prefer bundled benefit options that would address various needs. Younger workers and blue-collar workers are particularly interested in this option. Yet, nearly twice as many employees (56%) would prefer to pick and choose their benefit options separately.

Two-thirds of employees (66%) who would prefer bundling believe that doing so would save them money. Other perceived advantages include:

“To help keep employees engaged, more can be done to improve the overall experience with these benefits” notes Landry. “At present, 71% of employees are at least somewhat satisfied with their benefits while 43% are very satisfied. We have an opportunity to equip both employers and employees with the tools and resources to improve the overall benefits experience.”

-end-

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 financial services member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257