Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

2/20/2025

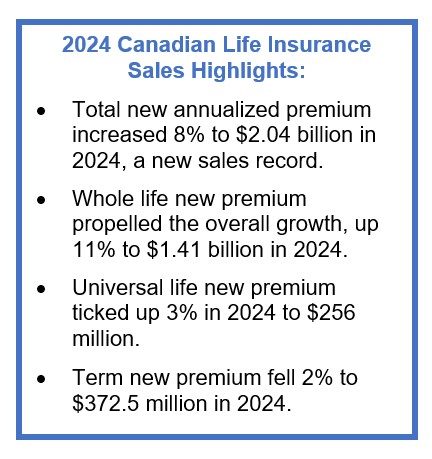

WINDSOR, Conn., Feb. 20, 2024 —Total Canadian life insurance new annualized premium was a record-high $2.04 billion (CAD) in 2024, 8% higher than in 2023, according to LIMRA’s Retail Canadian Life Insurance Sales Survey.

“Record-high whole life and strong universal life new premium propelled overall market growth in 2024. That said, the number of policies fell 5% in 2024, marking the fourth consecutive year of policy sales declines. With 30% of Canadian adults saying they live with a coverage gap, it is critical for our industry to do more to reach underserved markets,” said John Carroll, senior vice president and head of Life & Annuities, LIMRA and LOMA. “The uncertainty of the trade relationship with the U.S. and the potential for increased inflation could make reaching these markets more challenging in 2025.”

“Record-high whole life and strong universal life new premium propelled overall market growth in 2024. That said, the number of policies fell 5% in 2024, marking the fourth consecutive year of policy sales declines. With 30% of Canadian adults saying they live with a coverage gap, it is critical for our industry to do more to reach underserved markets,” said John Carroll, senior vice president and head of Life & Annuities, LIMRA and LOMA. “The uncertainty of the trade relationship with the U.S. and the potential for increased inflation could make reaching these markets more challenging in 2025.”

In the fourth quarter, new annualized premium totaled $593.2 million, up 14% from prior year. Policy count dropped 5% in the fourth quarter, compared with results from fourth quarter 2023.

Whole Life

Whole life new annualized premium topped $431.2 million in the fourth quarter, an 18% jump from prior year’s results. The number of whole life policies sold was level with fourth quarter 2023.

Whole life new premium set a new record, rising 11% to $1.41 billion in 2024. Policy count was flat for the year. Whole life premium represented 69% of the total Canadian life insurance market in 2024.

“Whole life sales drove the overall growth in the Canadian life insurance market this year. Participating whole life product sales led the growth, representing 90% of whole life new premium,” said Matthew Rubino, senior research analyst, LIMRA Insurance Product Research. “More than half (54%) of carriers selling participating whole life products reported sales double-digit gains this year.”

Universal Life

Universal life (UL) new annualized premium increased for the third consecutive quarter. UL new premium was $67.4 million in the fourth quarter, 8% higher year over year. Non-level cost of insurance (COI) product sales drove the product line’s the growth in the quarter and for the year. The number of policies sold rose 6% in the fourth quarter.

In 2024, UL new premium totaled $256 million, 3% above 2023 sales. Policy count also grew, up 3% year over year. UL premium held 13% of the total Canadian life insurance market in 2024.

Term Life

Following a double-digit sales decline in the third quarter, term life insurance sales rebounded in the fourth quarter. Term new annualized premium grew 2% in the fourth quarter to $94.6 million. Policy count, however, fell 11% in the quarter.

For the year, term new premium was $372.5 million, down 2% from 2023 results. The number of term policies sold was 10% lower than in 2023. In 2024, term premium held 18% market share.

“Term sales were unusually high in 2023, a result of product innovations and new affiliations among a few carriers,” said Rubino. “Term new premium dropped in 2024 due to declines in other term and 20-year term product sales. That said, term new premium n 2024 was 6% higher than 2022 results.”

For more details on the sales results, go to Canadian Life Insurance Sales Growth Rates (Fourth Quarter 2024) in LIMRA’s Fact Tank.

Started in 1993, LIMRA’s Canadian Individual Life Insurance Sales Survey represents 93% of the Canadian market. With more than 100 years of expertise, LIMRA conducts over 80 benchmark studies — producing nearly 500 reports annually — for our members and the industry as a whole. These studies provide trusted insights and a comprehensive understanding of market dynamics, trends, and behaviors.

-end-

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257