Related Research

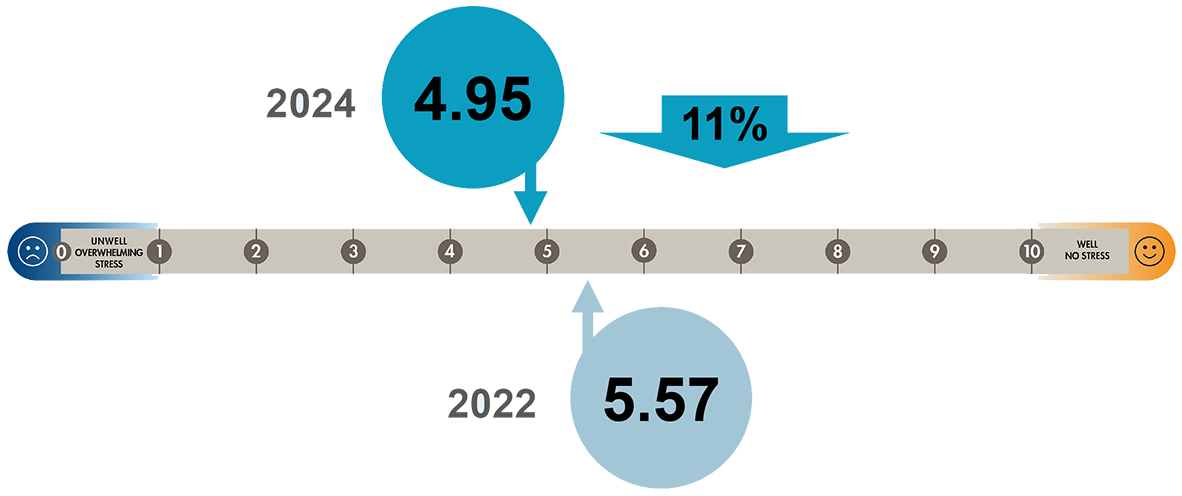

LIMRA Financial Wellness Index® — Quantifying Financial Wellness as a Basis for Improving It: 2024 Update

The LIMRA Financial Wellness Index® helps financial and benefits providers, advisors, and the industry quantify financial wellness. It is a first step towards understanding how financial wellness can fit into employer benefits strategies, personal advice, and financial readiness strategies. Demographic views allow for a richer understanding of financial wellness in various populations.

LIMRA Financial Wellness Spectrum: Understanding Consumer Wellness, Situations, Expectations, and Needs

“Financial Wellness” is multi-faceted. Explore the interplay of financial, physical, and emotional factors in five financial wellness types.

Financial Wellness: A Key Driver of Workplace Productivity

Financial wellness significantly impacts employee well-being and productivity. Employers offering financial wellness programs can reduce employee stress, improve job satisfaction, and enhance overall workplace efficiency, leading to lower turnover and better business performance.

- Thought Leadership

- Trending Insights

- Distribution Channels

- Full Service Broker-Dealer

- Independent Broker-Dealer

- Registered Investment Advisor (RIA/IAR)

- Independent Agency/Brokerage

- Direct-to-Consumer

- Consumer

- Customer Experience

- Generations

- Multicultural Markets

- Wealth Markets

- Women

- Employer

- Workplace Benefits

- Voluntary/100% Employee Paid

- Retirement

- Retirement, Institutional/Workplace

- Retirement Income

- Retirement Planning

- Retirees and Pre-Retirees

- Marketing

- Talent Management

- Rewards & Recognition