Anti-Money Laundering for Insurance Review – The Impact of Artificial Intelligence (2025)

LIMRA’s 2025 AML course enhances understanding of money laundering within the insurance industry and explores ways artificial intelligence (AI) can create efficiencies for those working in insurance. It also prepares learners to recognize and prevent AI from being leveraged in fraudulent schemes.

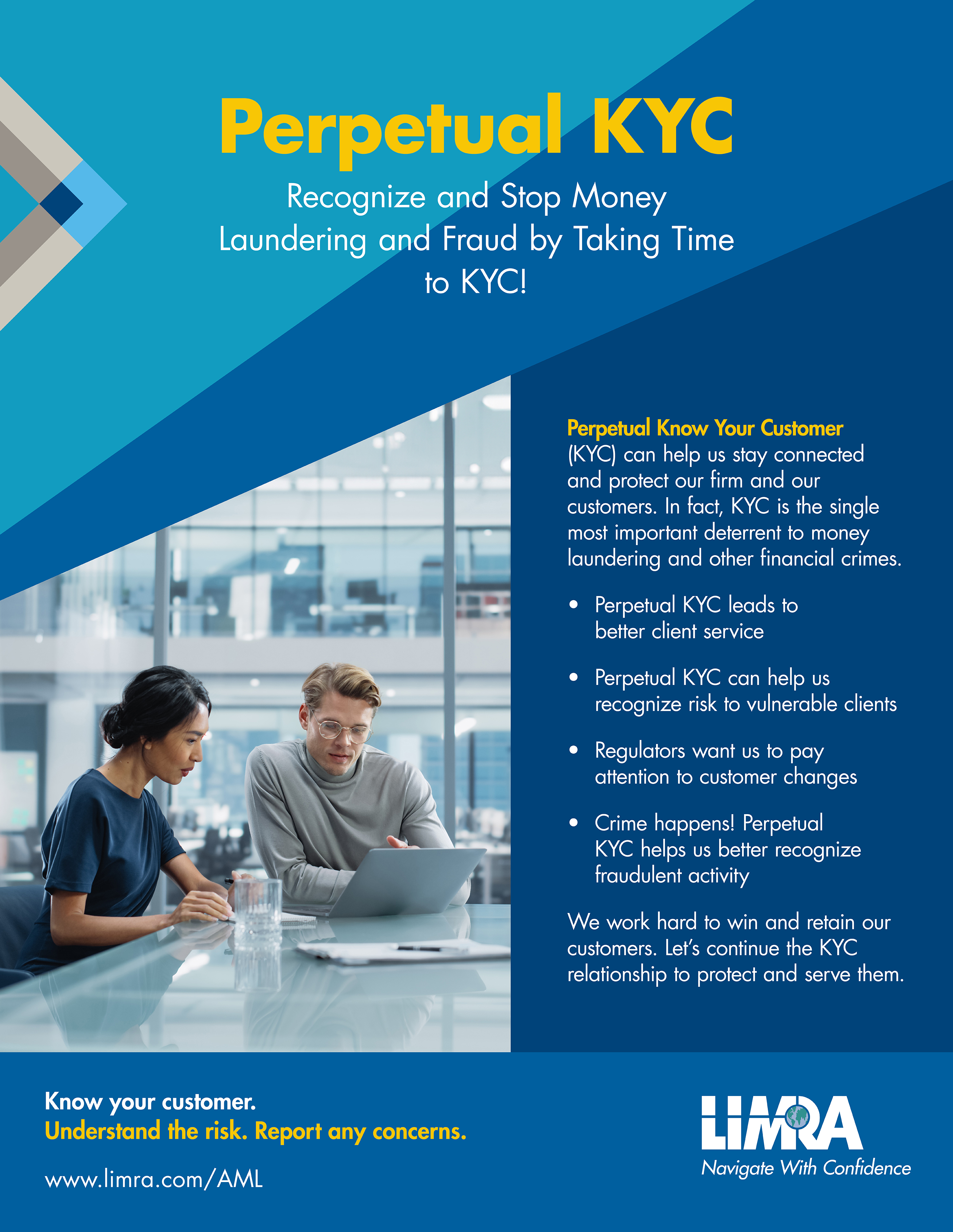

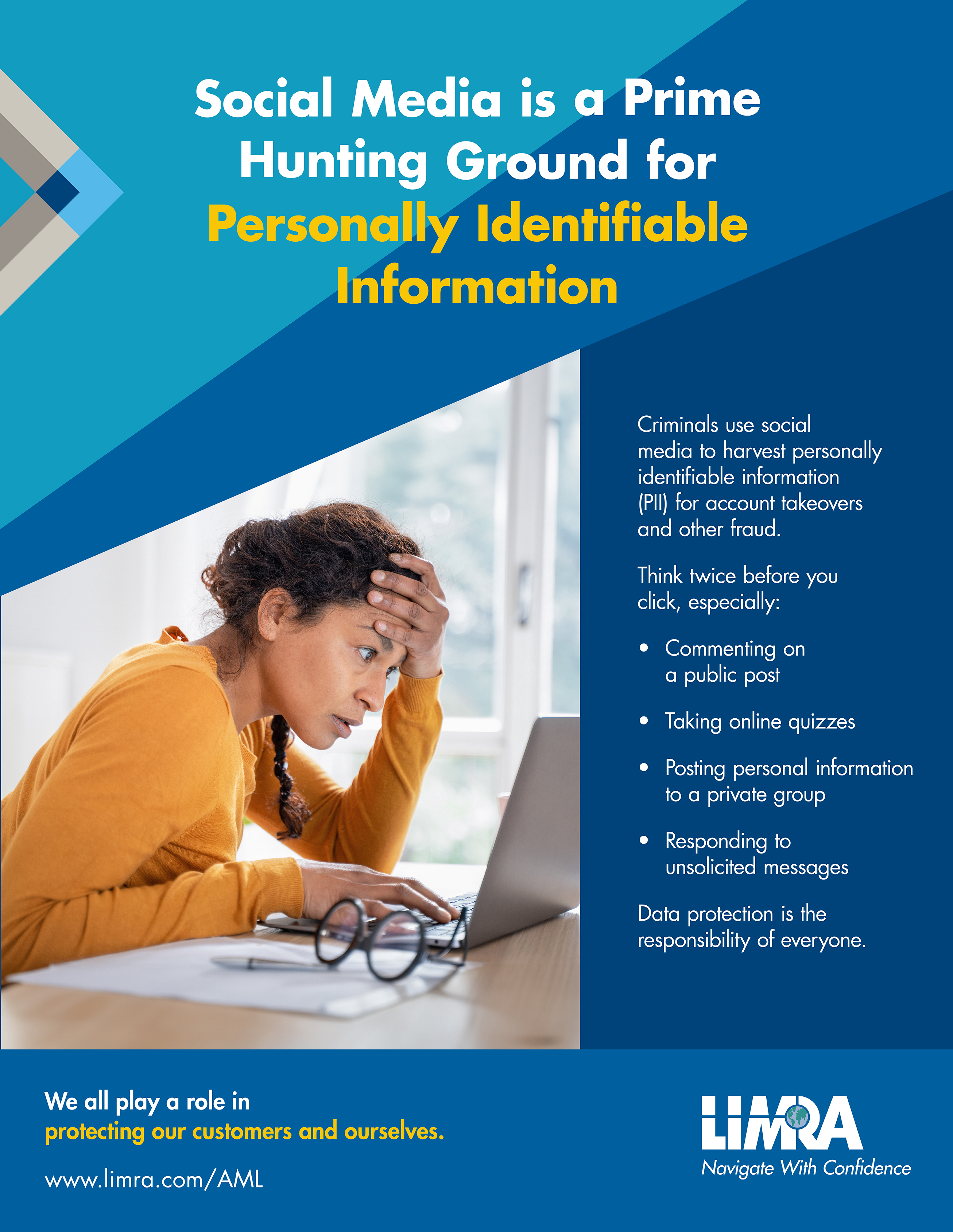

The course reviews important topics like Know Your Customer, Customer Identification Program, Activity Monitoring and Red Flags.

The LIMRA Program also includes an AML Resource Library, available 24/7, where learners can review course content. The Library includes insurance-specific awareness posters and images that can be shared to heighten attention to potential money laundering.

A branded company page offers companies the opportunity to customize program content with specific and unique information learners need to know.

Learn more about how you can protect your company, employees, financial professionals and customers today by completing the form below.

The Evolving Money Laundering Threat: Understanding and Preventing Scams

Our latest topical course focuses on understanding common scams and how they work. This course will dive into recognizing customers who are vulnerable to scams, identifying emerging scam typologies and how AI plays into scams, and best practices for recognizing and stopping scams.

The course reviews important topics like Know Your Customer, Customer Identification Program, Activity Monitoring and Red Flags.

Interested in learning more about this course launch? Fill out the form below to stay updated on our newest course, launching in January 2026.