RILAs: Flagship Annuity

Product for the Future

RILAs: Flagship Annuity

Product for the Future

August 2024

For the first time, registered index-linked annuities (RILAs) have outsold traditional variable annuities in quarterly sales, both in the fourth quarter of 2023 and first quarter of 2024. In fact, over the past several years, RILAs have already become the flagship products for several large annuity manufacturers, and for good reason. The product line offers a host of advantages to insurance companies, advisors and end customers, filling a need that hasn’t been met by other annuity products in the marketplace.

This innovative financial instrument allows insurers to diversify their product offerings, attract a broader customer base and potentially increase profitability. RILAs present a unique opportunity for insurance companies to capitalize on market trends while managing their risk exposure. Many insurance companies have strategically changed their product suite mix largely from traditional variable products with living benefit guarantees and put focus on RILAs, which offer higher returns, downside protection and more balanced product risk. Overall, there are now 20 companies selling 38 RILAs, of which 7 offer guaranteed living benefits (GLBs). Since first quarter 2020, 12 annuity manufacturers have entered the RILA space.

Advisors are also seeing the benefits of RILAs, which allow them to offer current and prospective customers market-linked returns, downside protection and technology efficiencies that facilitate incorporating these products into a client’s financial plan and overall portfolio. Current market dynamics are also allowing end customers to “have their cake and eat it too,” thanks to strong participation rates, caps and positive equity performance.

The customer need for protection with upside has grown, which positions products like RILAs and fixed indexed annuities (FIAs) favorably as potential products of choice for advisors. Sales for both products have done extremely well, especially since the onset of the pandemic. Although RILAs and FIAs have product similarities, there are some key differences between the product lines.

| RILAs | FIAs | |

Downside Protection |

Offer a buffer or floor against losses, but policyholder can lose money outside of the protection levels |

Provide full principal protection, guaranteeing no loss of initial investment |

Upside Potential |

Generally, offer higher potential returns due to greater market participation |

Typically have more limited upside potential due to more conservative crediting methods |

Regulatory Oversight |

Registered as securities with the SEC, subject to securities regulations |

Considered insurance products, regulated by state insurance departments |

Guaranteed Income Options |

May offer optional income riders, which are actually more common in FIAs |

Frequently offer guaranteed lifetime income riders |

Insurer Risk |

Allow insurers to transfer more market risk to policyholders |

Require insurers to bear capital risk to guarantee principal |

RILAs were introduced after the Great Recession ended in June 2009 — with the first product offered in 2010. RILA sales exploded in 2020 as the global pandemic had investors seeking protection. In 2023, that growth continued with sales totaling 47.4 billion and increasing 15 percent year over year, reaching another all-time high.

According to LIMRA benchmarking data, sales of RILAs continued to be concentrated through independent broker-dealers (BDs), accounting for over half of all RILA sales and experiencing 15 percent growth in 2023. Banks accounted for 17 percent of 2023 RILA sales and experienced a 14 percent increase from the prior year. Although full-service national BDs had the lowest sales of all available distribution channels at $3.4 billion, as competing alternative solutions such as structured notes are more readily available through these large BDs, sales grew by 26 percent year over year.

According to LIMRA’s most recent Deeper Dive Report on RILAs, almost two-thirds of RILA sales were qualified/IRA sales. Most of these sales were within products six years or shorter in contract length. In addition, almost 90 percent of RILA sales are without a GLB.

The key value proposition of RILAs is to provide protected accumulation, a balance of downside protection and growth potential of the investment. Two common types of protection features are buffers and floors.

If a buffer is included, the insurance company takes the investment risk up to a set percentage. The investor, however, will absorb any loss above that percentage. If a floor is incorporated, the investor takes the investment risk up to a specified percentage. The insurance company will bear the investment risk if the selected index return is below the floor level.

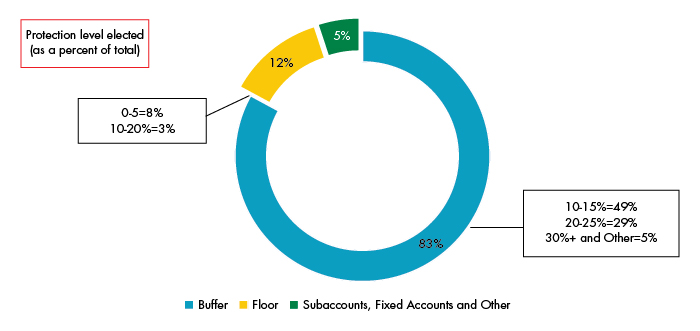

According to LIMRA’s Deeper Dive Report on RILAs, over 80 percent of sales utilized a buffer strategy. Almost half had a 10-15 percent protection level.

In addition to protection strategies, RILA products offer different types of crediting methods and index options.

In 2022, the most popular crediting method continued to be the cap rate strategy. This strategy allows growth up to a certain limit or “cap” based on the duration of the crediting strategy. Other prevalent crediting methods in RILA products included participation rates and step rates. Regarding index options, many of the prevalent indices available on RILA contracts are popular equity market indices such as the S&P 500, Russell 2000 and NASDAQ-100. Over three-quarters of 2022 RILA sales went with the popular S&P 500 index.

As the annuity landscape continues to evolve, RILAs are well positioned for sustained growth in the coming years and will be at the forefront of their product suite of annuities. The unique blend of market participation and downside protection offered by RILAs addresses a critical need for uncertain and volatile economic environments, particularly for retiring Baby Boomers and risk-aware Gen X and Gen Y investors. Insurance companies are likely to expand their RILA offerings, driven by increasing consumer demand and the product line's ability to balance growth potential with risk management.

Moreover, as financial advisors become more familiar with RILAs and their benefits, we can expect to see further adoption across various distribution channels. The flexibility of RILA design also allows insurers to innovate and tailor products to emerging market trends, ensuring their continued relevance. With their ability to meet diverse investor needs and provide value to both consumers and insurers, RILAs are poised to become an increasingly significant component of retirement planning strategies, cementing their position as a flagship product line in the insurance industry for years to come.